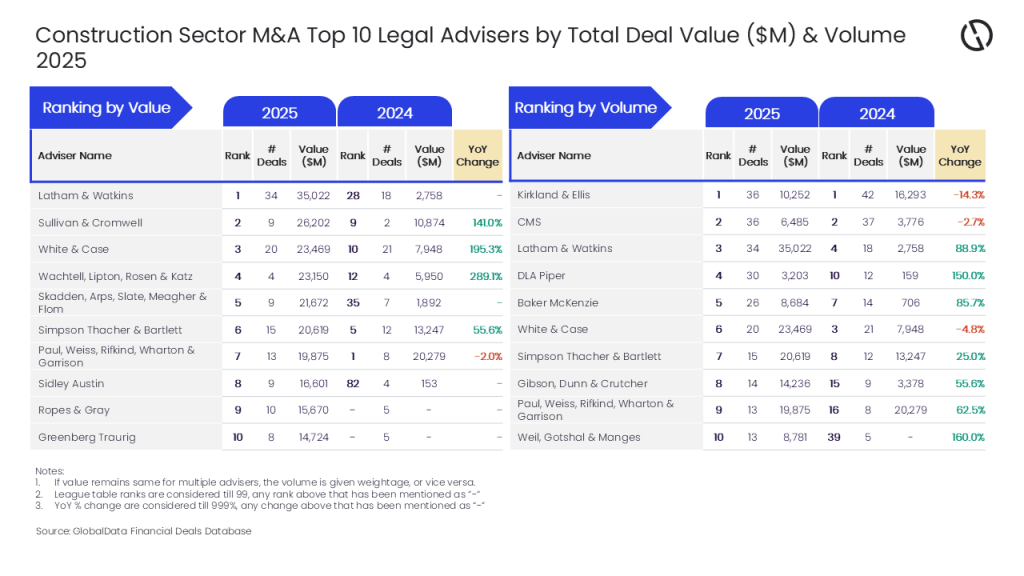

Latham & Watkins and Kirkland & Ellis have emerged as the leading legal advisers in mergers and acquisitions (M&A) within the construction sector for 2025, as reported in the latest league table by GlobalData.

The data, sourced from GlobalData’s Financial Deals Database, indicates that Latham & Watkins topped the rankings by deal value, advising on transactions worth $35bn. In contrast, Kirkland & Ellis led in deal volume, facilitating a total of 36 transactions.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis was the top adviser by volume in 2024 and retained its leadership position by this metric in 2025 as well, despite a year-on-year drop in the total number of deals advised by it.

“Meanwhile, Latham & Watkins was well ahead of its peers in terms of value. During 2025, Latham & Watkins advised on 14 billion-dollar deals* and involvement in these big-ticket deals helped it secure the top spot by value. Moreover, it also held the third position by volume during 2025.”

Following Latham & Watkins in value, Sullivan & Cromwell secured the second position with advisory services on $26.2bn worth of deals.

White & Case ranked third with $23.5bn, while Wachtell, Lipton, Rosen & Katz and Skadden, Arps, Slate, Meagher & Flom followed closely with $23.2bn and $21.7bn, respectively.

In terms of deal volume, CMS also ranked second with 36 transactions, while Latham & Watkins, DLA Piper, and Baker McKenzie completed the list with 34, 30, and 26 deals, respectively.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.

*Deals valued more than or equal to $1bn