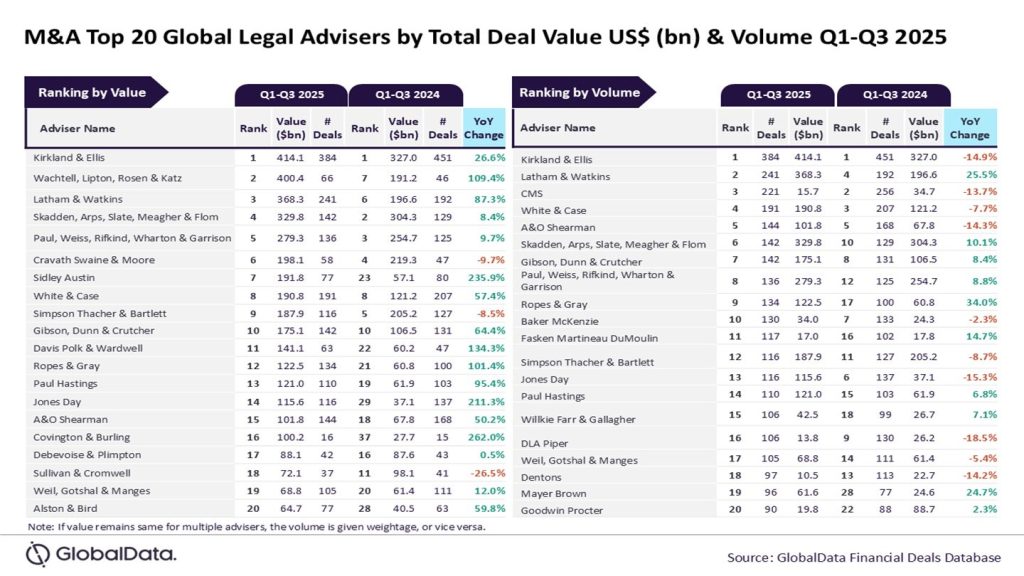

Kirkland & Ellis has secured the foremost position as a legal adviser in the mergers and acquisitions (M&A) sector in terms of value and volume for the first three quarters of 2025 (Q1-Q3).

This was determined by the Legal Advisers League Table, a comprehensive analysis of GlobalData, a prominent data and analytics firm.

The Financial Deals Database analysis disclosed that Kirkland & Ellis attained this top rank by providing counsel on 384 transactions, which cumulatively amounted to $414.1bn.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis was also the top adviser during Q1-Q3 2024 by both value and volume. The Chicago-based law firm outpaced its peers by a significant margin in terms of volume. In fact, it was the only adviser that managed to advise on more than 300 deals during Q1-Q3 2025.

“Kirkland & Ellis was also involved in several big-ticket deals, which helped it top the table by value. It advised on 69 billion-dollar deals, which also included 10 mega deals valued more than $10bn.”

Wachtell, Lipton, Rosen & Katz claimed the second spot in the value category, having advised on deals aggregating to $400.4bn.

It was followed by Latham & Watkins with deals totalling $368.3bn, Skadden, Arps, Slate, Meagher & Flom with $329.8bn, and Paul, Weiss, Rifkind, Wharton & Garrison with $279.3bn in advised deal value.

In the volume category, Latham & Watkins also secured the second spot, advising on 241 deals.

It wasS followed by CMS handling 221 deals, White & Case with 191, and A&O Shearman with 144.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.