The construction industry continues to be a hotbed of innovation, with activity driven by an increased focus on environmental sustainability and workplace safety, and the growing importance of technologies such as the Internet of Things (IoT) and robotics. In the last three years alone, there have been over 248,000 patents filed and granted in the construction industry, according to GlobalData’s report on Innovation in Construction: Hydraulic excavator drive system. Buy the report here.

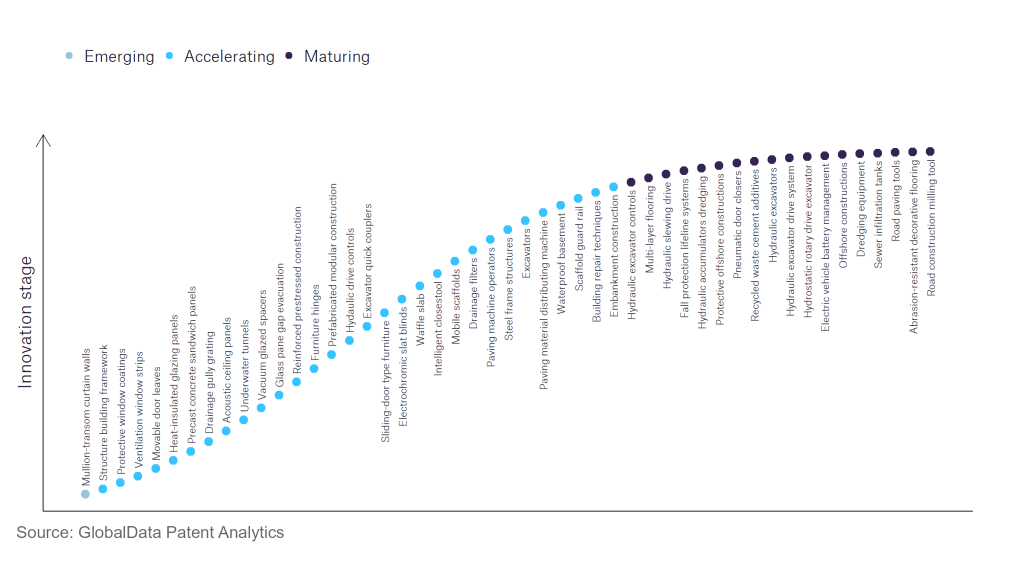

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

80+ innovations will shape the construction industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the construction industry using innovation intensity models built on over 179,000 patents, there are 80+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, mullion-transom curtain walls are disruptive technologies that are in the early stages of application and should be tracked closely. Heat- insulated glazing panels, drainage gully grating, and acoustic ceiling panels are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are abrasion-resistant decorative flooring and road construction milling tool, which are now well established in the industry.

Innovation S-curve for the construction industry

Hydraulic excavator drive system is a key innovation area in construction

Excavators use hydraulic drive systems to facilitate the movement of their components through the use of hydraulic fluid power. The excavator can utilise hydraulic energy by allowing hydraulic fluid to pass through a system of valves that direct the flow of the fluid, thus converting hydraulic energy to mechanical energy which, in turn, moves the component of the excavator.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 50+ companies, spanning technology vendors, established construction companies, and up-and-coming start-ups engaged in the development and application of hydraulic excavator drive system.

Key players in hydraulic excavator drive system – a disruptive innovation in the construction industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to hydraulic excavator drive system

Source: GlobalData Patent Analytics

A leading company in the hydraulic excavator drive system space is Liebherr, which has recently filed a patent for an alternative to open and closed-circuit systems for hydraulic motors through the use of a hydraulic drive comprising a hydraulic motor that includes a first and second hydraulic connector. The motor will convert hydraulic energy into mechanical energy and is driven by a difference in pressure between the first and second connectors. The rotary movement generated by the hydraulic motor is then determined by the displacement volume of the hydraulic motor and by the quantity of the hydraulic fluid flowing through the hydraulic motor. Other leading companies in the space include Kubota, Manitowoc, and HAWE Hydraulic.

In terms of application diversity, the leading companies are Tesmec, Manitowoc, and Sany. The leading companies in terms of geographic reach are Tesmec, Syn Trac, and Manitowoc.

To further understand the key themes and technologies disrupting the construction industry, access GlobalData’s latest thematic research report on Construction.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.