The construction industry continues to be a hotbed of innovation, with activity driven by an increased focus on environmental sustainability and workplace safety, and the growing importance of technologies such as the Internet-of-Things (IoT) and robotics. In the last three years alone, there have been over 248,000 patents filed and granted in the construction industry, according to GlobalData’s report on Innovation in Construction: Hydraulic excavator controls. Buy the report here.

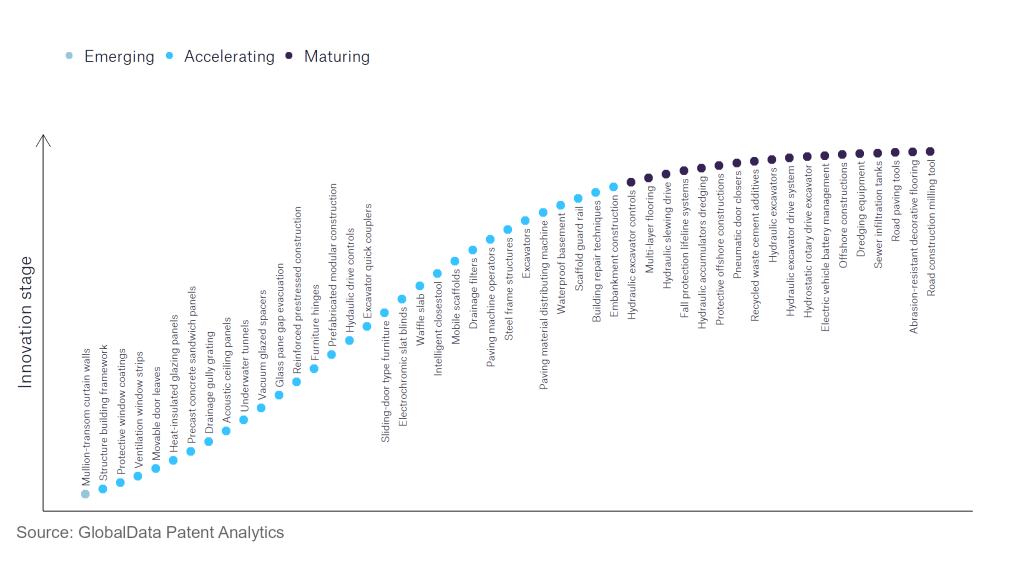

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

80+ innovations will shape the construction industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the construction industry using innovation intensity models built on over 179,000 patents, there are 80+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, mullion-transom curtain walls is a disruptive technology that is in the early stages of application and should be tracked closely. Heat insulated glazing panels, drainage gully grating, and acoustic ceiling panels are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are abrasion-resistant decorative flooring and road construction milling tool, which are now well established in the industry.

Innovation S-curve for the construction industry

Hydraulic excavator control is a key innovation area in construction

Hydraulic excavators are controlled by a system of joysticks and levers that allow the operator to control the moving parts of the machine to perform an excavation. With increasing digitisation and the use of data, control systems are becoming more advanced, giving the operator more options to configure the machine to perform different tasks more efficiently and safely. Innovations in this space include speed detectors and variable speed limit settings, as well as fuel-optimisation modes.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 10+ companies, spanning technology vendors, established construction companies, and up-and-coming start-ups engaged in the development and application of hydraulic excavator control.

Key players in hydraulic excavator control – a disruptive innovation in the construction industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to hydraulic excavator control

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Hitachi | 132 | Unlock Company Profile |

| Komatsu | 111 | Unlock Company Profile |

| Caterpillar | 23 | Unlock Company Profile |

| Sumitomo Heavy Industries | 17 | Unlock Company Profile |

| Doosan Infracore | 12 | Unlock Company Profile |

| CNH Industrial | 11 | Unlock Company Profile |

| Deere & Co | 10 | Unlock Company Profile |

| Danfoss | 9 | Unlock Company Profile |

| Kobe Steel | 9 | Unlock Company Profile |

| Toyota Motor | 8 | Unlock Company Profile |

| Kawasaki Heavy Industries | 7 | Unlock Company Profile |

| J C Bamford Excavators | 6 | Unlock Company Profile |

| Liebherr-International | 5 | Unlock Company Profile |

| Iwabuchi | 5 | Unlock Company Profile |

| Parker Hannifin | 5 | Unlock Company Profile |

Source: GlobalData Patent Analytics

A leading company in the hydraulic excavator space is Hitachi, one of the world’s leading manufacturers of hydraulic excavators. Among its recent innovations is the use of motor control devices, which allow the operator to control the rotational speed of the motor. It allows the excavator to be run at different power settings, to save power or to utilise full power depending on the task. It also gives the operator greater control over the speed of the moving components of the excavator and automatically adjusts power temporarily to facilitate faster travel while in its power-saving mode. Other leading companies in the space include Komatsu, Caterpillar, and Sumitomo.

In terms of application diversity, the leading companies are Parker Hannifin, Danfoss, and Kobe Steel, while the leading companies in terms of geographic reach include Kobe Steel, JC Bamford, and Sumitomo.

To further understand the key themes and technologies disrupting the construction industry, access GlobalData’s latest thematic research report on Construction.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.