Construction activities in the US residential sector started off on a weaker note in 2023, with the total value of construction put in place (measured in seasonally adjusted nominal terms) falling by 4.1% year-on-year (YoY) in the first two months of this year (the latest data available at the time of writing). The US housing market has borne the brunt of the interest rate hikes, amid efforts by the Federal Reserve (Fed) to tame inflation.

The Fed announced its ninth-straight interest rate hike of 25 basis points in March 2023. With this move, it increased the federal funds rate from nearly 0% in March 2022 to a range of 4.75-5%. The Fed is likely to hike rates further by 25 basis points in early May 2023, as the job market continues to remain tight and inflation is still at higher levels, despite easing in recent months.

Considering the surge in mortgage rates, high construction costs, supply chain disruptions, labour shortages, and fall in permits for new privately owned housing units, GlobalData expects the US residential construction sector to remain weak in 2023. Reflecting the current weakness in the housing sector, housing construction starts fell sharply in the first three months of 2023.

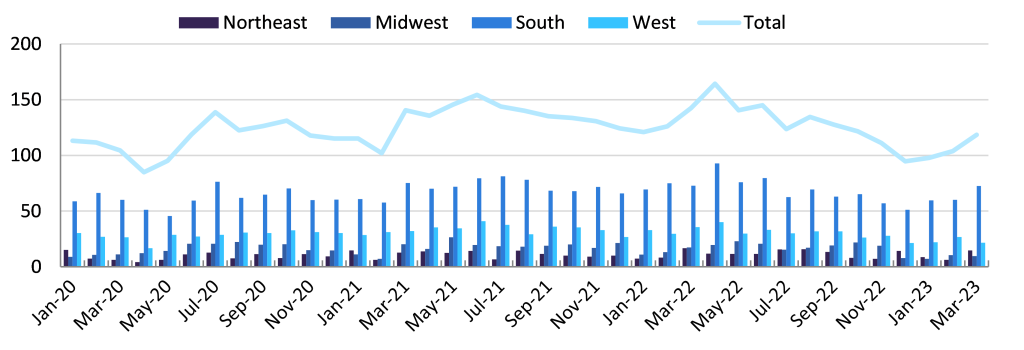

According to the US Census Bureau, the total number of new privately owned housing units on which construction started in the country (measured in unadjusted terms) plummeted by 17.9% YoY in the first quarter (Q1) of this year, falling from 389,700 units in Q1 2022 to 319,800 units in Q1 2023.

This weakness is attributed to a fall in construction starts of one-unit houses (-28.6% YoY) and two-to-four-unit houses (-31.8%); in contrast, housing construction started on houses with five-or-more units rose by 6.4% YoY in Q1 2023.

In terms of regional segmentation, housing construction starts registered YoY falls of 34.5%, 28.2%, 11.5% and 8% in the Midwest, West, South and North-East regions, respectively, in Q1 2023. Of the total number of housing units on which construction started in Q1 2023, the majority of the units – equivalent to 60.1% – were in the South; this was followed by the West (22.1%), North-East (9.3%) and Midwest (8.5%) regions.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe US, housing starts by regions (unadjusted), in thousands

The US’ National Association of Home Builders (NAHB) expects the housing market recession to continue into 2023, amid elevated inflation rates, and high building material construction costs. Mortgage rates also remain high, but have eased back from the highs of late 2022. The 30-year fixed mortgage rate stood at 6.43% on April 27th, 2023, which was down from the recent peak of 7.08% in November last year, but still high compared to 3.11% at end-2021.

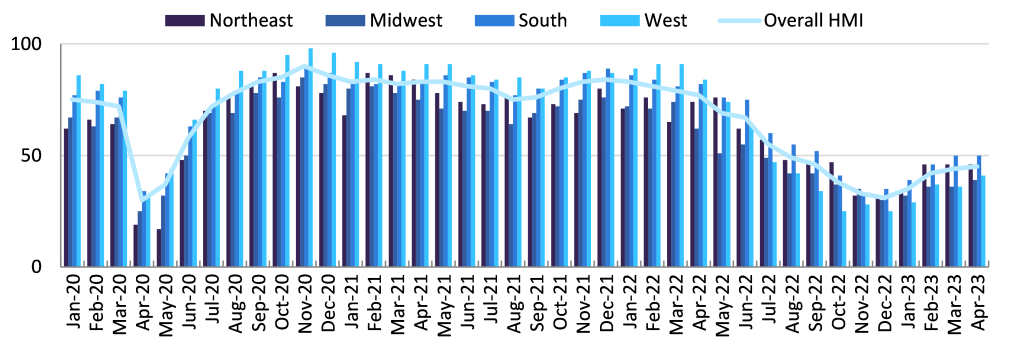

Home builder sentiment continues to recover, although it is still depressed. According to the NAHB, the seasonally adjusted NAHB/Wells Fargo Housing Market Index (HMI) – which measures confidence among single-family home builders -builder confidence in the market for newly built single-family homes rose one point to 45 in April 2023. This marks the fourth straight month of improvement in builder confidence, as limited resale inventory is helping to increase demand in the new home market.

However, despite the improvement in confidence, the score had remained below 50 for the ninth consecutive month in April 2023. Builder confidence in the market for newly built single-family homes remained weak across all regions, with the average HMI registering a score of 35.8 each in the Midwest and West regions, 43 in the North-East and 46.3 in the South regions in the first four months of 2023. A reading above 50 indicates a favourable outlook on home sales, while that below 50 indicates a negative outlook.

The US, NAHB/Wells Fargo national and regional HMI, seasonally adjusted

Although the residential construction sector is expected to shrink in 2023 and 2024, GlobalData expects the sector to begin recovering from 2025, supported by the government’s focus on providing affordable housing in the country. The government announced $175bn in housing investments, as part of the $6.9tn budget proposal unveiled in March 2023. The investments aim to reduce housing costs, expand housing supply, improve access to affordable rental options and homeownership, and advance efforts to reduce homelessness by 25% by 2025.