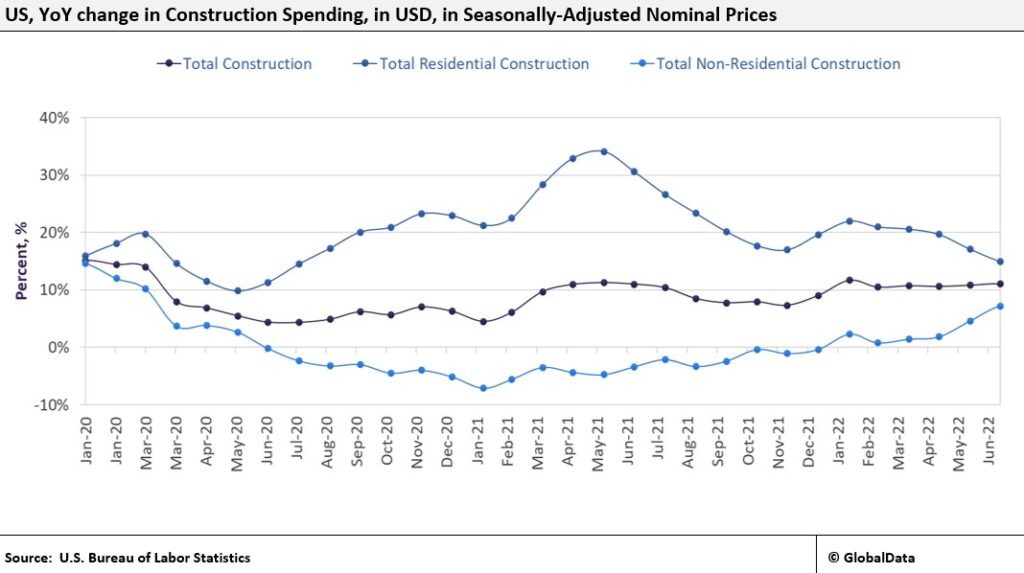

Newly released “Construction Spending” data shows the industry continues to struggle in the current economic environment. Recently released data for September 2022 shows that, in seasonally adjusted nominal terms, the industry grew 0.2% from August 2022 and 10.9% compared to the previous year. Overall construction spending growth has remained stable over the past year, mostly maintaining double-digit growth throughout the year. However, as this data is in nominal terms, the expansion mainly reflects the jump in prices across the industry. The balance between residential and non-residential sector growth has also been shifting. The residential sector has shown persistent deceleration in month-on-month (MoM) growth over the past four months, and year-on-year (YoY) growth has followed a downward trend from May 2021. Meanwhile, non-residential construction growth has accelerated, in February 2022, YoY growth turned positive and stood at 9.2% as of September 2022.

In major markets globally, the quickly deteriorating macroeconomic environment has taken policymakers by surprise, and central banks have responded to inflationary pressure by aggressively increasing interest rates. Elevated material prices, supply-side bottlenecks, labour shortages are causing delays and postponements of projects. In addition, investment in new projects will likely fall as further rate hikes will restrict access to credit. In late October 2022, the Federal Reserve increased benchmark interest rates for the sixth-consecutive time by 0.75% to 4%.

The US residential sector is taking the brunt of the increases in interest rates, mortgage rates hit 7% in late October 2022, and housing demand is plummeting. The housing market now appears to be on the edge of a downturn; according to the US Census Bureau, the latest housing starts and permit data (September 2022) shows that demand has eased significantly as mortgage rates have risen. New residential permits registered a 10.0% drop from July 2022 to August 2022 and a 14.2% drop from April 2022 and are nearing pre-pandemic levels. Housing starts dropped 8.1% from August 2022 and 20.3% from April 2022. Residential construction spending will likely follow this trend.

All but two non-residential sectors saw contractions over September 2022; non-residential construction spending was mainly supported by the manufacturing sector, which performed strongly, recording a 7.6% MoM expansion and 43% over the year. This is largely driven by ‘re-shoring’ and increased dynamism to move technology supply chains away from Asia and China in particular. Industrial construction will be further bolstered over the longer term by the CHIPS and Science Act (which will put around $80 billion in semiconductor manufacturing) and the Inflation Reduction Act (which will put $369bn into energy security and climate change initiatives over the next ten years, including EV manufacturing subsidies and many others).

Highway and street construction spending is starting to see an upturn growing 1.5% within the month after performing poorly over the past year. The $1.2 trillion Infrastructure Investment and Jobs Act signed in late 2021 shows signs that funding is starting to feed through to project development. The Department of Transportation recently allocated $76.7bn to all states, with $53.7bn allocated to roads, bridges, and major projects, and will likely drive further growth in this sector. In addition, transportation, water, and sewage construction spending, which saw contractions in September, will likely see an uptick in activity in the coming months.

It is important to note that these figures are in nominal terms and do not consider key input cost increases. In real output terms, the construction industry contracted 8.5% YoY in Q2 2022 following two consecutive contractions. The construction industry has faced intense pressure from material price increases and labour shortages. Construction costs were up by 20.6% over the year but are gradually flattening, with construction costs increasing 0.4% over the month.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData