Despite the challenging macroeconomic environment, the UK construction industry is estimated to have grown by 2.2% in 2023, aided by ongoing works on existing infrastructure projects in the energy and transport markets. Infrastructure construction is estimated to have grown by 7.2% and energy construction by 23.1% during the year.

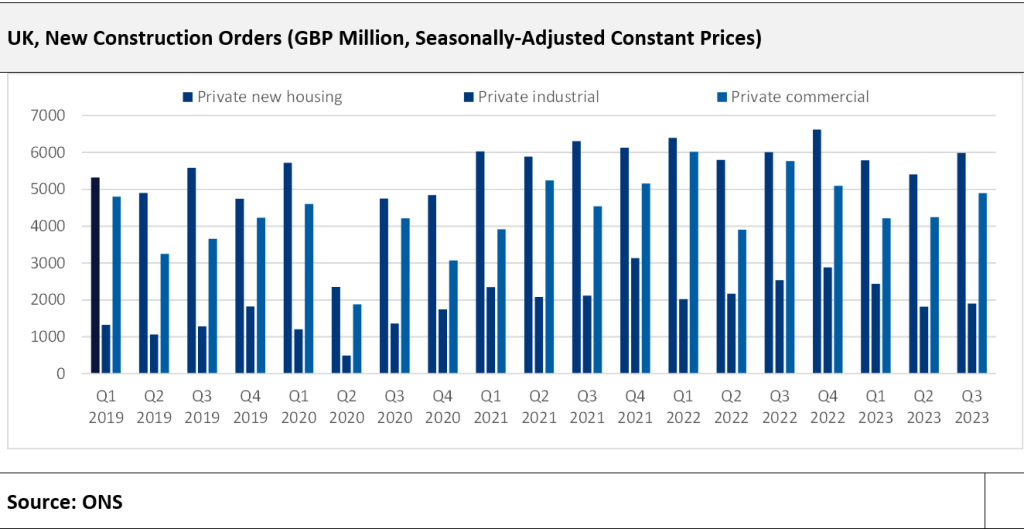

But constraints such as high interest rates and inflationary pressure are limiting the overall industry output’s growth, as evidenced by a decrease in order levels and new investments. According to the Office for National Statistics, the total value of new construction orders fell by 12% year on year (YoY) in the first nine months of 2023, due to drops in other new infrastructure orders (-28%), private commercial work orders (-14.8%), private industrial orders (-8.5%), and private new housing orders (-5.6%). While there has been positive growth in new public housing work orders (28.9%) and other new work orders excluding infrastructure (5.9%). Private sector confidence has continued to deteriorate amid concerns that interest rates will remain at current levels for longer than expected. In contrast, public sector orders remained relatively stable in 2023 as a result of a carryover of government departmental capital budgets to the 2024 financial year (1 April 2024 to 31 March 2025).

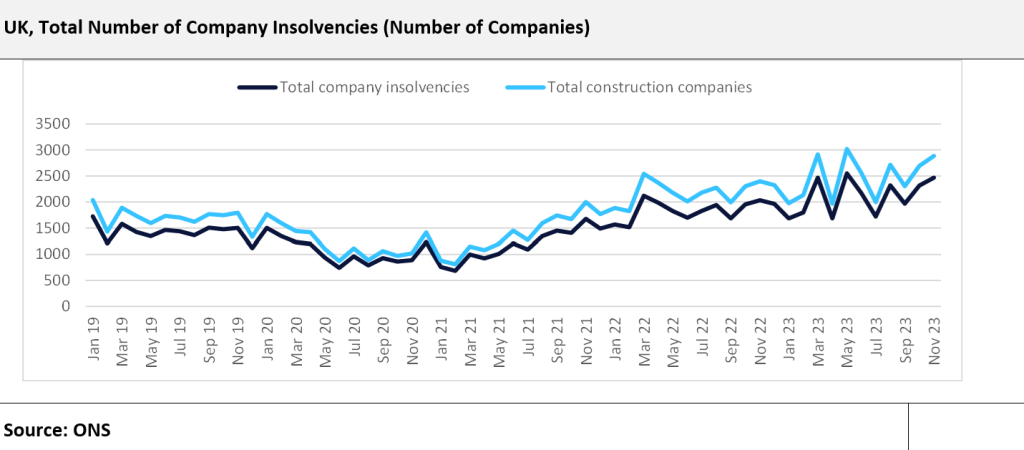

Elevated material costs, high interest rates and labour shortages are the primary issues confronting construction companies. Total business insolvencies increased by 14.8% YoY in the first eleven months of 2023, totaling 23,157 companies, and construction companies reporting insolvencies increased by 5.4% YoY, totaling 4,011. Construction insolvencies accounted for 17.3% of total company insolvencies.

By segment, building construction company bankruptcy increased by 8.3%, specialised construction activity company bankruptcy increased by 4.6% and civil engineering company bankruptcy decreased by 5.3%. The Bank of England’s Monetary Policy Committee (MPC) has kept the bank rate at 5.25% in February 2024 since September 2023, but this follows fourteen consecutive increases from 0.25% in January 2022 to 5.25% in September 2023.

Meanwhile, inflationary pressure is easing. The average Consumer Price Index stood at 4.2% between November 2023 and January 2024, compared with 4.7% in October 2023 and 6.3% in September 2023. Accordingly, the MPC has projected that the bank rate will remain around 5.25% until the third quarter of 2024 before gradually declining to 4.25% by the end of 2026.

Uncertainty will persist in 2024, as bank rates remain high and the 2024 general election poses further challenges. The two major UK political parties diverge on attitudes towards sustainability, planning, infrastructure and housebuilding, and skilled labour shortage and elevated material costs are also threats to the industry. According to the Confederation of British Industry, 71% of UK businesses have experienced labour shortages in 2023 and 77% of businesses polled believe that lack of access to skills threatens the UK’s current labour market competitiveness. With the current high demand for skilled personnel in the UK construction sector, it is estimated that an additional 45,000 workers per year will be required by 2027 to meet growing construction demand.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAll of this is expected to adversely affect both the housing market and business confidence. The residential construction sector, which accounted for 44.9% of total construction output in 2023, is forecast to decline by 4.7% in 2024. Commercial and infrastructure segments are also expected to decline by 5.1% and 4.7% respectively.

Expected decreases in inflation and interest rates are expected to support the construction industry in the second half of 2024. The Chancellor of the Exchequer presented the 2023 Autumn Statement to the UK Parliament in November 2023, including a section designed to cut taxes and boost the ailing UK economy. The government also announced that it will unlock the construction of thousands of homes and speed up both the planning process and electricity grid connections across the country. It has also promised to speed up the approval process so that major infrastructure projects can be approved within 30 months, which was the average time achieved in 2012.