How Rising Interest Rates Affect Material Prices

The residential construction sector in Canada remained resilient despite the pandemic and registered stable growth over the last two years. This was supported by the government’s pandemic-related stimulus measures, coupled with record-low interest rates and the subsequent ultra-low borrowing costs. According to Statistics Canada, investments in the residential sector (measured in seasonally adjusted terms) rose sharply by 11.1% in 2021. The sector’s growth is expected to decelerate in 2022, owing to rising raw material costs, rising inflation, falling residential permits, and weaker housing demand.

Reflecting the impact of rising raw material costs, the average residential building construction price index rose by 22.6% year-on-year (YoY) in Q1 2022 (the latest data available at the time of writing), marking the fifth consecutive double-digit YoY growth since Q1 2021. The continuous rise in raw material prices is expected to lead to a further increase in residential construction costs in the coming quarters.

According to Statistics Canada, the total raw material prices (excluding crude energy products) rose by 14.8% YoY in May 2022 (the latest data available at the time of writing) while the prices of logs, pulpwood, natural rubber and other forestry products, and metal ores, concentrates and scrap registered YoY growth of 33.9% and 5.8%, respectively, during that month. Cumulatively, the average raw material price index rose by 18.6% in the first five months of this year. The average price index for logs, pulpwood, natural rubber and other forestry products, and metal ores, concentrates and scrap rose by 34% and 10.8%, respectively, during the same period.

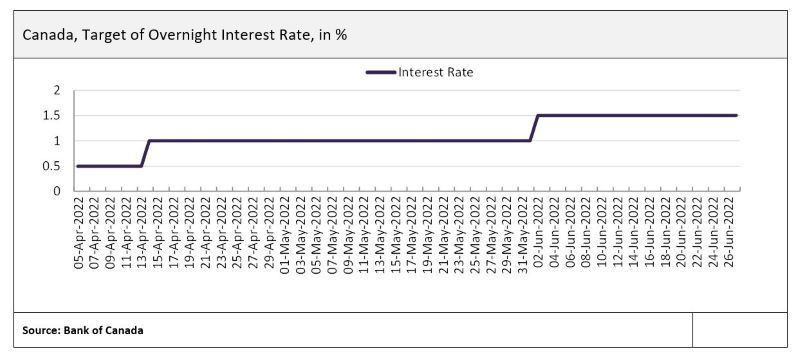

Rising inflation is also expected to weigh on consumer confidence, thereby affecting housing demand in the coming quarters. According to Statistics Canada, annual inflation rose to its highest level in nearly 40 years in May 2022 (the latest data available at the time of writing), amid soaring gas prices. The Consumer Price Index (CPI) rose by 7.7% YoY in May 2022, up from a YoY rate of 6.8% in the previous month; this marks the 15th consecutive month with inflation above the Bank of Canada’s target of 2%. To tame the surge in inflation, the Bank of Canada raised its key overnight interest rate by 50 basis points to 1.5% in early June 2022, up from 1% in early April 2022. The bank also signalled the possibility of further interest rate hikes in the coming months.

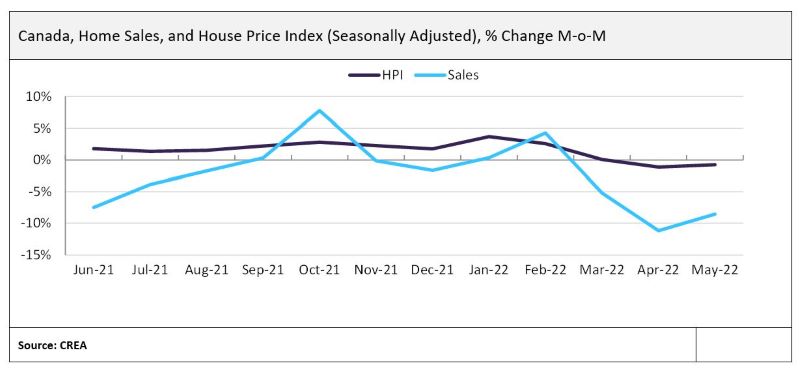

The Canadian housing market has started to show signs of cooling, owing to the recent rise in interest rates. Reflecting subdued consumer confidence, home sales and housing prices have started to fall due to higher borrowing costs. According to the Canadian Real Estate Association (CREA), national home sales fell by 8.6% month-on-month (MoM) in May 2022 (the latest data available at the time of writing), marking the third consecutive MoM contraction since March 2022. Moreover, the seasonally adjusted MLS Home Price Index (HPI) also fell by 0.8% MoM in May 2022, following a MoM decline of 1.1% in the previous month. Home prices fell for all categories of housing, except apartments, in May 2022. During that month, the sharpest MoM contraction was witnessed for single family homes (-1%), followed by that for one-storey homes (-0.9%), two-storey homes (-0.7%), and townhouses (-0.6%); in contrast, it rose marginally by 0.4% for apartments.

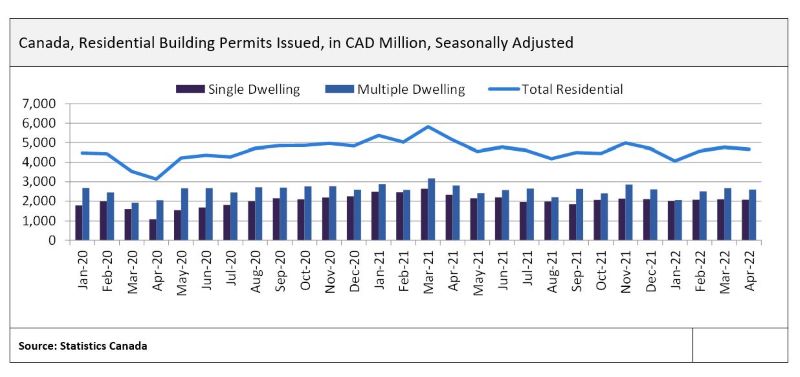

In another setback for the sector, residential building permits have been falling in the recent months. According to Statistics Canada, the total value of residential building permits issued in the country fell by 9.1% YoY in April 2022 (the latest data available at the time of writing), marking the fifth consecutive YoY contraction since December 2021. This decline is attributed to a fall in both single dwelling (-11.1% YoY) and multi dwelling (-7.5% YoY) permits. Cumulatively, the total value of residential permits issued fell by 15.3% in the first four months of this year, declining from C$21.3 billion ($17.2 billion) in January-April 2021, to C$18.1 billion ($14.6 billion) in January-April 2022. By segments, the value of permits issued for single dwellings fell by 16.7% YoY while that for multiple dwellings fell by 14.1% YoY, during the same period.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

According to the Canada Mortgage and Housing Corporation (CMHC), homeownership affordability is expected to decline over the coming months owing, to rising mortgage rates and growth in home prices outpacing income growth. It also expects that home prices, housing sales, and housing starts will moderate from the recent highs, but remain elevated in 2022. On a positive note, the improving levels of employment and immigration could provide a boost to the housing demand over the coming years.