Bangladesh’s longest-serving Prime Minister Sheikh Hasina – who had been in power for the past 15 years – resigned and fled the country on 5 August 2024, following weeks of protests that led to the death of more than 300 people. The former prime minister’s resignation plunged the country into political uncertainty. A 17-member interim government was formed on 8 August, with Mohammad Yunus, a Nobel Peace Prize recipient and founder of a small microfinance institution, Grameen Bank, as its chief advisor. Political unrest erupted in the country in mid-July 2024, after the country’s high court reinstated a quota system for government jobs; this decision overturned Hasina’s move in 2018 to abolish a system that reserved 30% of jobs for families of fighters from the 1971 independence war. Protestors claimed that the quota system is discriminatory, as it replaces the merit-based system and benefits the supporters of Hasina, whose Awami League party led the independence movement. Following days of deadly protests, the government imposed a nationwide curfew and ordered the deployment of military forces, in late July 2024.

The political instability has dealt a blow to the country’s garment sector, which accounts for over 84% of the national exports every year; it has forced factories to temporarily shut down and has resulted in order delays and disruption to garment shipments. According to preliminary estimates from industry associations, the sector is estimated to have lost Tk97.1bn ($814m) as a result of the protests, as of late July 2024; additionally, orders lost during the communication blackout are estimated to be approximately Tk477.4bn.

Construction is also one of the sectors that was affected by the recent protests in Bangladesh. According to market participants, the movement of construction labour, materials, local and foreign consultants, and other relevant personnel have been affected by the protests, resulting in project delays. Project and other relevant document approval processes have also been affected, while communication with development partners has been restricted due to the internet blackout. Government officials reported that some projects that have already been approved by the planning minister and by the prime minister-headed Executive Committee of the National Economic Council are facing delays in receiving their administrative orders due to the current impasse. Additionally, at least 12 Project Evaluation Committee meetings have been postponed.

In late July 2024, the Foreign Investors Chamber of Commerce and Industries (FICCI) reported that the curfew and internet blackout in Bangladesh significantly affected the domestic economy, with cumulative losses estimated to be more than Tk1.2trn. The FICCI reported that several investors in the country are uncertain other whether to resume their regular operations, with the country’s image as a reliable investment destination diminished. This is likely to affect foreign direct investment (FDI) inflows to the country, at a time when it is in desperate need of foreign funds to diversify its manufacturing sector and attain its goal of becoming a developed country by 2041. To attain its 2041 goal, the country needs to attract FDI equivalent to 1.66% of its gross domestic product annually.

In another setback, in late July 2024, the American credit ratings agency S&P lowered Bangladesh’s credit ratings from BB- to B+. The downgrade reflects elevated external vulnerabilities such as depleting foreign-exchange reserves, an unfavourable balance of payments, and rising debt service costs. According to the Central Bank of Bangladesh, the country’s net foreign exchange market reserves stood at Tk2.6 trillion at the end of June 2024; this is 35% lower than the figure in June 2023 and is enough to cover only approximately 3.3 months of current-account payments. High inflation, rising interest rates, limited access to foreign exchange, and policies aimed at limiting imports will further weigh on economic output in 2024, with a recovery expected to begin from 2025.

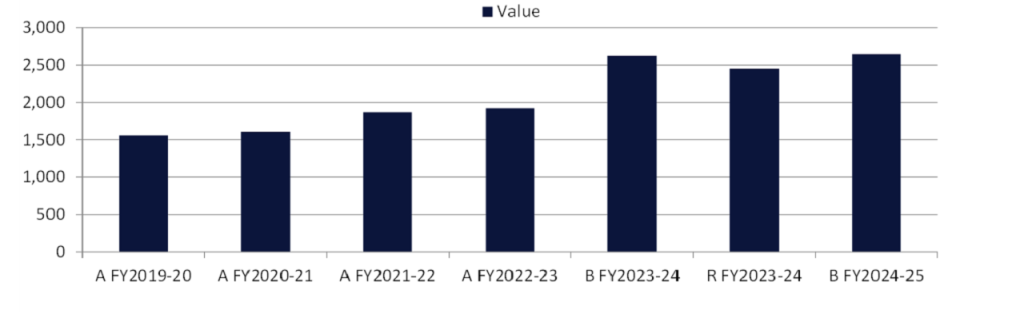

In addition to the political unrest, the severe flooding, which occurred in north-east Bangladesh during June 2024, is expected to impact construction output this year. A total of 18 districts were affected as of early July 2024, with locals now demanding the construction of permanent dams to protect their homes. According to government data, approximately 2.5 million people across the country were affected by the floods. Considering the current economic and political turmoil in the country, leading data and analytics company GlobalData expects growth in Bangladesh’s construction industry to slow from 9.5% in 2023 to 6.2% in 2024. The industry’s output in 2024 will be supported by the government’s expenditure of Tk8trn announced as part of the financial year 2024-25 budget, that was released in June 2024. The budget includes an operating expenditure of Tk5.1 trillion and a development expenditure of Tk2.8trn. The development expenditure includes an allocation of Tk2.7trn for the Annual Development Programme (ADP). Some of the major allocations announced as part of the FY24-25 ADP include Tk320.4bn for the Road Transport and Highways Division, Tk291.8bn to the Power Division, Tk137.3bn to the Ministry of Railways, Tk86.9bn to the Ministry of Water Resources, and Tk73.1bn to the Bridges Division.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData