Israel’s construction industry has been severely impacted since the start of the ‘Swords of Iron’ war in early October 2023, mainly owing to a sharp reduction in labour supply and a downturn in investor confidence. The government has imposed a ban on Palestinian labour entering Israel following the attacks, which has resulted in a severe shortfall in manpower, with the construction industry particularly hit badly. According to Israel’s Finance Ministry, economic damage owing to the ban on Palestinian workers is estimated at approximately $830m per month. Amid worker shortage, Israeli contractors are competing for fewer workers, and paying higher wages. Moreover, the government’s order to mobilise 350,000 reservists is expected to exacerbate the labour shortage.

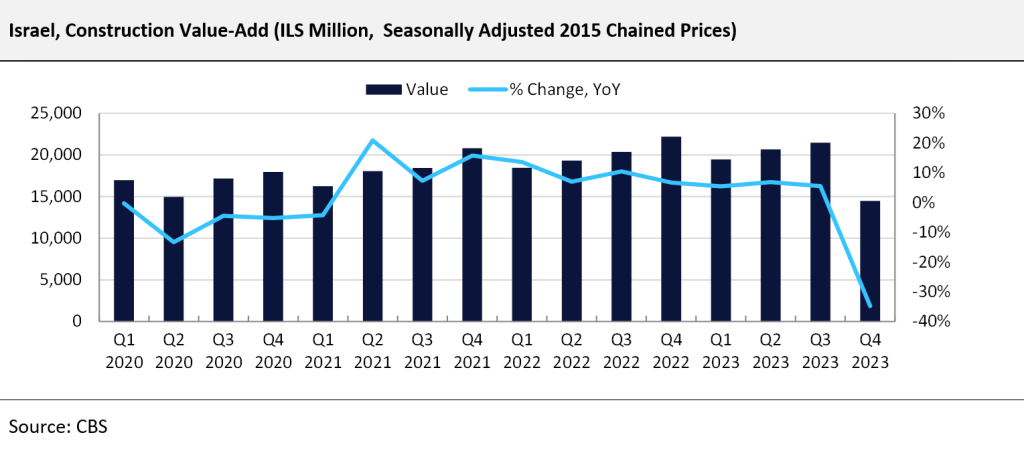

As of January 2024, around 58% of the construction sites in the Jerusalem region and 41% of the building sites in the Tel Aviv and central regions had been shut down since the start of the war, according to the survey conducted by the Central Bureau of Statistics (CBS). As a result, Israel’s construction industry’s value add contracted sharply by 34.8% year on year (YoY) in Q4 2023, compared with cumulative YoY growth of 5.9% in Q1-Q3 2023, according to CBS. Therefore, the overall construction industry value-add declined by 5.3% annually in 2023, preceded by annual growth of 9.3% in 2022.

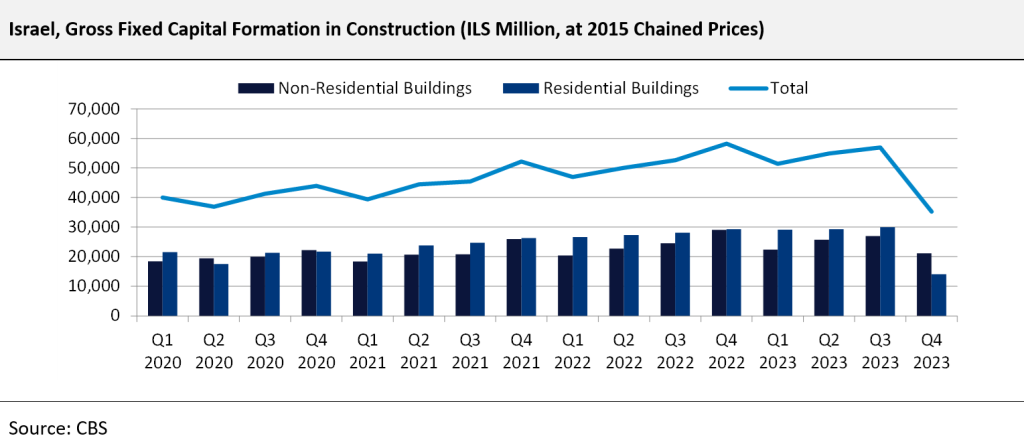

Ongoing weakness in construction activities is also reflected in the recent sharp fall in gross fixed capital formation in construction. According to Israel’s CBS, gross fixed capital formation in construction declined by 39.6% YoY in Q4 2023, preceded by YoY growth of 8.2% in Q3 and 9.7% in Q2 2023. Cumulatively, the total gross capital formation declined by 4.5% YoY in 2023, with the gross capital formation in residential buildings falling by 8% YoY during the same period. With subdued investor and consumer confidence, the construction industry’s outlook for the near term remains gloomy.

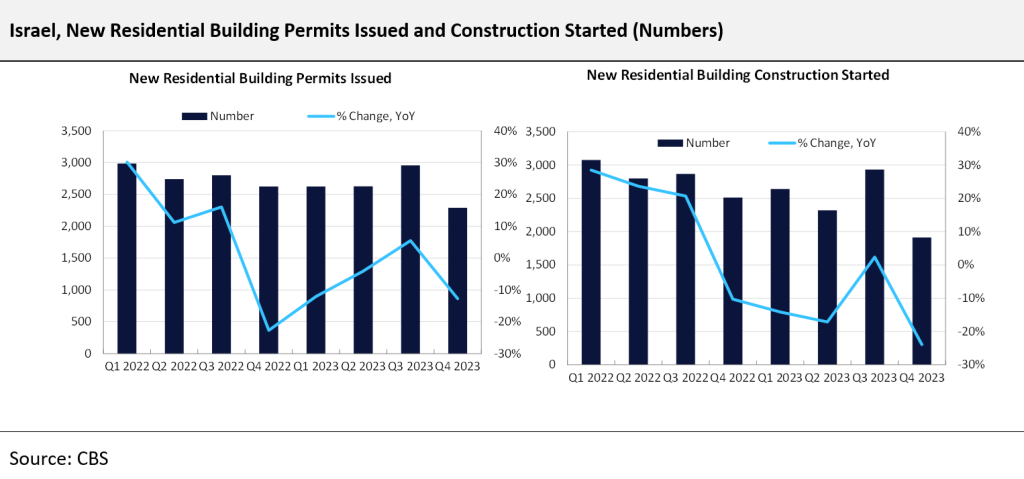

The residential construction sector, which accounts for the largest share of Israel’s construction industry (57.1% in 2023) was affected the most following the onset of the war with Hamas, leading to the cancellation, delay and halt of housing projects. According to CBS, the total number of new residential building permits issued in the country fell by 12.7% in Q4 2023, whereas, the total number of new residential building construction started declined sharply by 23.9% during the same period. Cumulatively, the total number of new residential building permits issued declined by 5.8% YoY in 2023, whereas the total number of residential building construction started contracted by 12.9% YoY during the same period.

Not only the construction sector, but Israel’s economy too shrank more than anticipated in the fourth quarter of 2023, with exports, consumer spending and investment hurt badly by the war. According to the CBS, the country’s GDP contracted sharply by an annualized 20.7% in Q4 2023, preceded by growth of 1.4% in Q3 and 2.7% in Q2 2023. To support overall economic activity, in its January 2024 monetary meeting, the Bank of Israel reduced the key interest rate by 25 basis points to 4.50%, in a bid to stabilize the country’s financial markets, ensure price stability, and reduce uncertainty. Moreover, in its February 2024 meeting, the Bank of Israel kept the interest rate unchanged.

In early February 2024, the credit rating agency, Moody’s downgraded Israel’s sovereign credit rating from A1 to A2, with the country’s economic outlook to negative. Moreover, in the same month, Moody’s downgraded the deposit ratings of Israel’s five largest banks. This move is expected to push up borrowing costs for banks, which in turn is expected to lead to higher lending rates and lower construction activities. However, in early April 2024, Fitch Ratings, an American credit rating agency removed Israel from Credit Rating Negative (RNW) and maintained the country’s sovereign credit rating at A+. Nevertheless, Fitch lowered the country’s economic outlook to negative from stable, owing to the war’s duration and intensity, and uncertainties around the fiscal trajectory.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn March 2024, the Israeli parliament approved an amended 2024 State Budget to fund the country’s war against the Islamist Palestinian group Hamas in Gaza, with a spending package of $160bn. The amended 2024 Budget is $19bn higher than the original 2024 budget approved before the outbreak of war, of which $15bn will be allocated towards the military. Moreover, as per the amended budget, the Israeli government budget deficit is expected to increase from 4.2% of the country’s GDP in 2023 to 6.6% in 2024. In February 2024, the deficit increased to 5.6% of GDP owing to the continued decline in tax revenue and the government’s fund allocation towards war. Rising budget deficits are expected to lead to a lack of funding available for construction projects, thereby leading to delays and the potential halt of construction projects. According to the Bank of Israel, the war-related costs are expected to amount to $55.6bn from 2023 to 2025, which will significantly dampen investor sentiment, hindering investment in the construction industry and stalling its growth.

Elevated material costs, high interest rates, and labour shortages will continue to pose downside risks to the construction industry in the first half of 2024, as GlobalData expects the war to continue in the second quarter of 2024. With the risk of intense operations in the second quarter of 2024, the government is expected to continue to spend high on military needs, which will affect construction activities in the country. In March 2024, the Federation of Israeli Chambers of Commerce announced that the construction industry is undergoing a slowdown of almost 50% in activity. However, the construction industry is expected to recover gradually in the second half of 2024, assuming political stability and war being short-lived, coupled with improvement in macroeconomic prospects. GlobalData expects the construction industry in Israel to contract by 1.3% in real terms in 2024, with a high likelihood of further declines if activity in the short term is more severely disrupted than currently anticipated.