Having made good progress in recovering from the severe downturn recorded in 2020 amid the widespread disruption caused by restrictions imposed due to Covid-19, the global construction industry is again facing severe headwinds. There is a high degree of uncertainty over the short-term outlook following Russia’s invasion of Ukraine, and the war will exacerbate existing supply chain disruptions, and put even greater upwards pressure on energy prices, which will further drive up prices for key construction materials. In addition to the devastation wrought on Ukraine by the military invasion, Russia’s economy stands to suffer a sharp recession given the sanctions imposed by Western governments and the withdrawal of foreign investors. The military conflict also threatens to destabilise the wider region, as investor confidence deteriorates while global inflationary pressures mean that monetary authorities will likely take action to tighten policy earlier than previously planned.

There are also still prevailing risks associated with the pandemic, particularly in markets with a “zero-COVID” policy, such as China, where the north-eastern province of Jilin recently went into full lockdown, and other restrictions have been imposed in major cities, including Shanghai and Shenzhen. However, in markets where there have been successful vaccine rollouts, international travel restrictions are being widely relaxed and day-to-day life and economic activity is returning to normal. Nevertheless, a resurgence in Covid-19 cases, the potential for restrictions on construction works, and the availability of labour remains a core downside risk to the outlook.

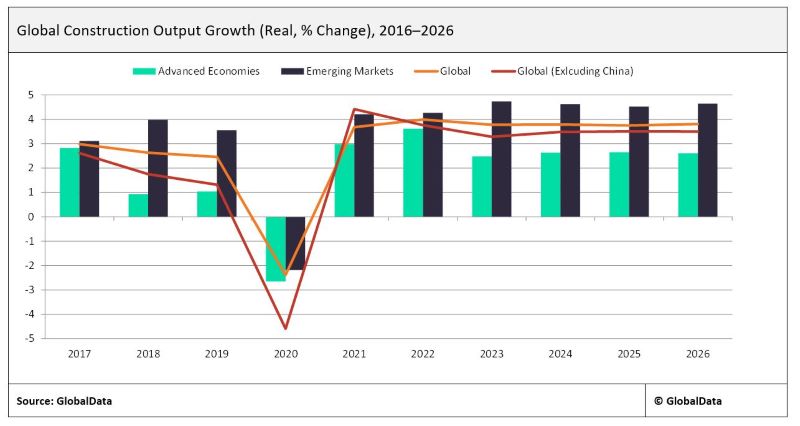

GlobalData’s best case scenario for the Russia-Ukraine conflict is that, following negotiations and some flexibility from Russia on the interpretation of its aims, Russia defines its invasion as a ‘victory’, allowing for a de-escalation by 2023. Russia would continue to apply military leverage against Ukraine while negotiations are ongoing, and sanctions remain on Russia until at least 2023, holding back Russia’s recovery from the 2022 decline. Following the lifting of sanctions, ‘self-sanctioning’ begins to ease, and the Russian economy re-opens. Under this scenario, GlobalData sees global construction output growing by 4.0% in 2022, down from the prediction of 4.9% in the previous quarterly update, before averaging 3.8% in 2023–2026. However, there are various scenarios that would result in a worse outcome, for example one in which Ukraine’s government rejects any demands, and Ukrainian resistance and Russian counter-insurgency results in prolonged instability and potentially drawing the involvement of other countries.

Under the base case scenario, the projection for construction output in Eastern Europe has been revised down sharply, with the region expected to contract by 3.3% in 2022. This reflects the sharp drop in output in Russia (a contraction of 9.2%), and the near collapse of activity in Ukraine, alongside the ongoing weakness in Turkey. In Western Europe, growth is projected to stand at 3.0%, down from the 3.8% expected previously, as the industry’s performance is undermined by high materials prices and supply chain disruptions. Of the EU’s imports of flat steel in 2020, Russia accounted for 14% and Ukraine for 8%, and for long steel products, Russia was the leading supplier, accounting for 19% of the total, and Ukraine supplied just over 7%. Belarus, which is also facing sanctions given its supporting role in Russia’s invasion of Ukraine, also provides approximately 14% of the EU’s imports of long products. The EU is also heavily reliant on Russia for natural gas imports.

The projection for slower growth in 2022 than previously anticipated also reflects ongoing challenges in China’s construction industry, in which growth slowed to just 2.1% in 2021, owing to a tightening of regulatory controls to limit borrowing by real estate developers. In Q3 2021, the Chinese construction industry contracted for the first time since the pandemic began, falling by 1.8% year-on-year (YoY), and this was followed by a 2.1% contraction in Q4. Policy tightening measures include the People’s Bank of China’s Three Red Lines policy, and limits on real estate development and mortgage lending at domestic banks. These measures have tightened liquidity conditions at some residential developers, most notably at Evergrande Group, which was downgraded to restricted default by Fitch Ratings in December 2021. Downside risks to the outlook include the continued restriction on developers to curb debt, which is expected to slow residential activity by private developers in the short-term.

Excluding China, the global construction industry posted a growth of 4.4% in 2021, and is set to slow to 3.8% in 2022. Performances across countries and regions will vary greatly, but South Asia and North America will be the best performers when comparing output in 2022 to the pre-Covid-19 levels. India suffered a sharp contraction in 2020 but rebounded in 2021, and in 2022 output across South Asia will be 9.5% higher than in 2019 in real terms. Owing to a strong performance in the residential sector in the US and Canada, total construction output in North America in 2022 is expected to be 5.5% higher than in 2019.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData