GlobalData expects Germany’s construction industry to contract by 4.7% in real terms in 2024, as construction spending continues to weaken due to rapid interest rate increases and a surge in construction costs that have forced major developers into insolvency. Growth in 2024 will also be affected by continued weakness in the residential sector, coupled with a sharp fall in building permits.

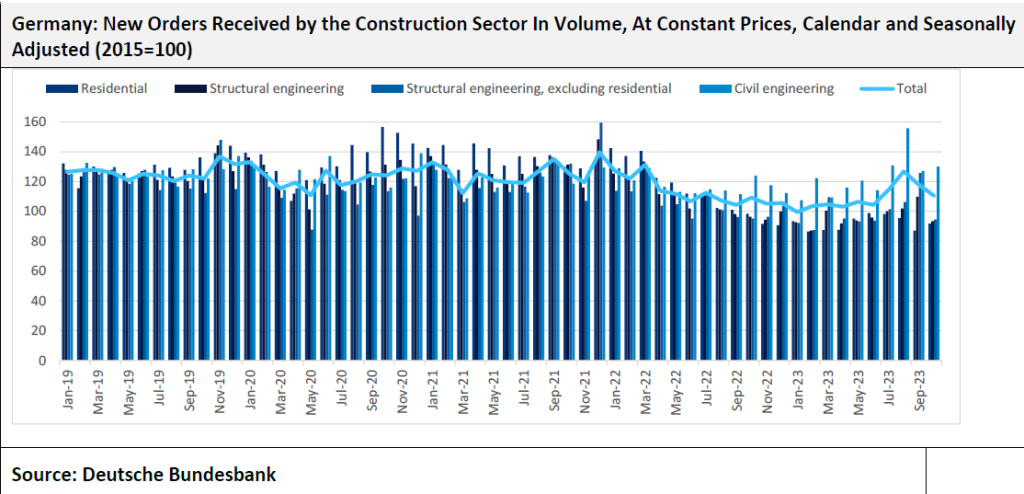

According to data published by Deutsche Bundesbank, total orders received by the construction industry in terms of volume index fell by 4.8% year-on-year (YoY) in the first ten months of 2023, following an overall annual fall of 9.8% in 2022. Residential construction orders were down by 22.3% between January and October 2023, followed by drops of 13.1% in structural engineering work orders and 5.9% in structural engineering, excluding residential work orders, while civil engineering work orders remained stable at 4.2% growth.

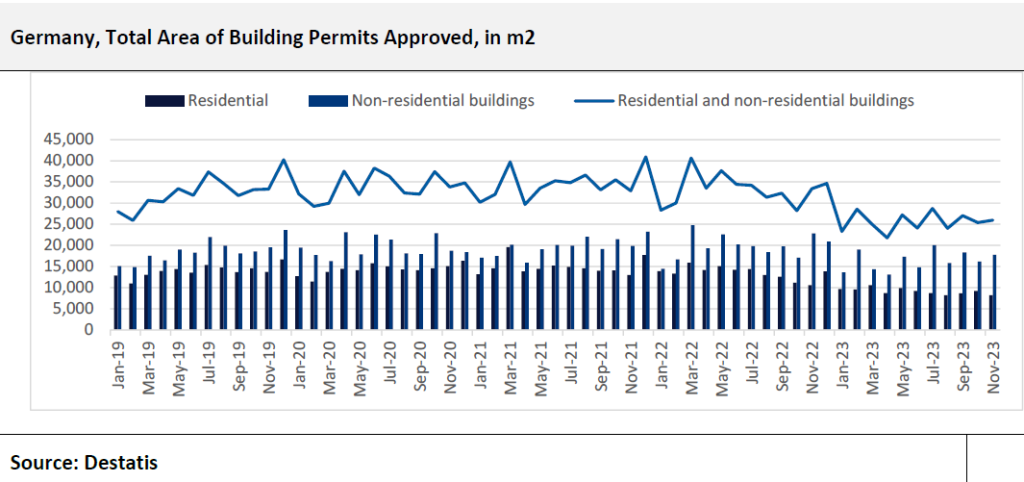

The Central Bank of Germany’s decision to raise interest rates (from -0.88% in December 2022 to 1.62% in January 2023, then to 3.12% in July 2023 and 3.62% in early January 2024) to combat inflation has had a significant impact on business owners, resulting in higher financing costs and weakened investments. According to a DIW [German Institute for Economic Research] study released in early January 2024, construction volume will fall by 3.5% to €546 billion ($597.38 billion) in 2024, before rising by 0.5% to €548.7 billion in 2025. In a setback to the industry’s output, the total area of building permits issued in the country fell 22.8% year-on-year (YoY) in the first eleven months of 2023, with permits issued for residential and non-residential buildings declining by 32.1% and 16.5% YoY, respectively, during that period.

By segments, permits for residential buildings with one or two apartments fell by 40.4%, while those with three or more apartments fell by 24.5% YoY. In nonresidential buildings, non-agricultural building permits fell by 17.9%, office and administration buildings by 16.6%, agricultural operational buildings by 12.3%, other non-residential buildings by 10.6% and institutional buildings by 8.9%.

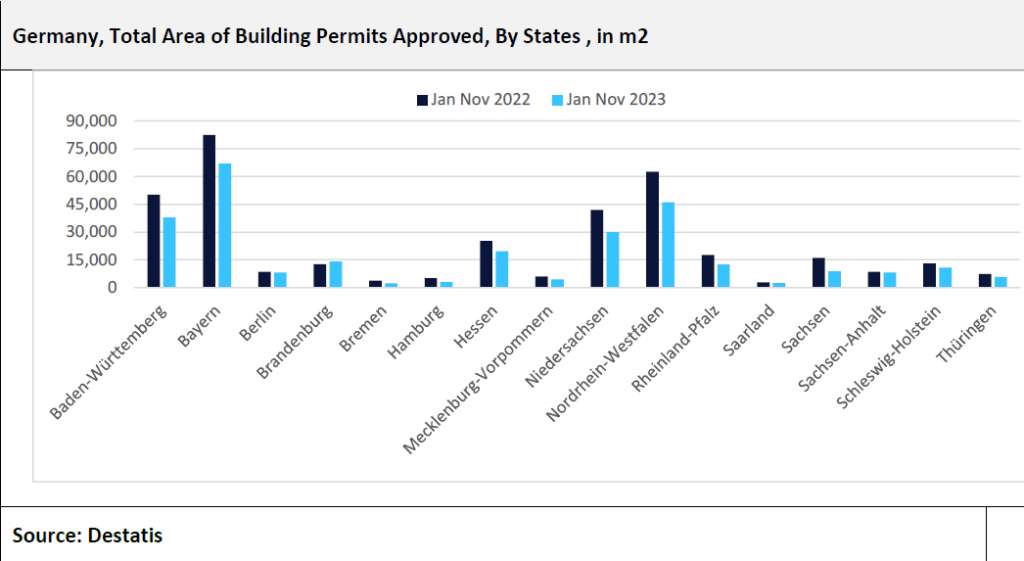

14 out of 15 German states have reported a significant decrease in building permits in 2023. Four states, Bayern, Nordrhein-Westfalen, Baden-Württemberg and Niedersachsen, accounted for 64.4% of total building permits issued between January and November 2023. However, they registered YoY declines of 18.7%, 26.3%, 24.6%, and 28.6% respectively during the same period. Sachsen recorded the sharpest decline (44.7%), followed by Hamburg (41.9%), Bremen (41.3%), Rheinland-Pfalz (29.1%), Mecklenburg-Vorpommern (27.4%), Hessen (22.1%), and Thüringen (20.2%).

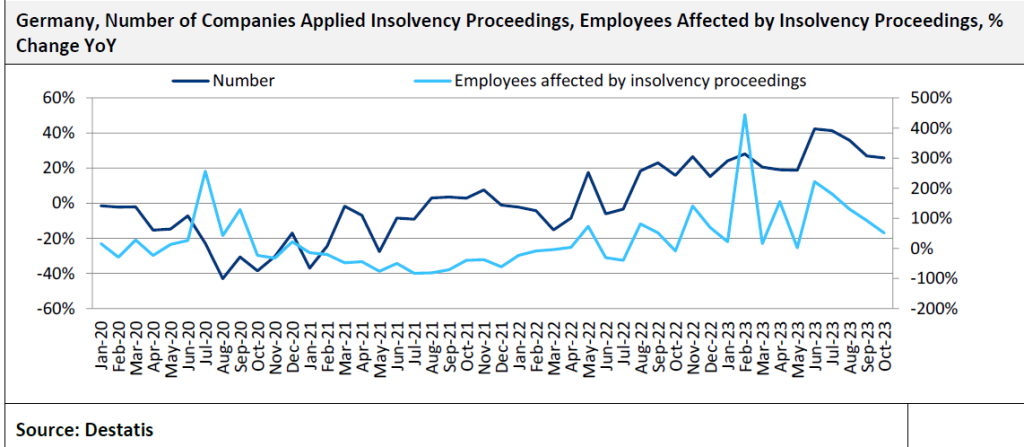

Rising number of insolvencies in the economy will have a direct impact on construction output in 2024. According to the Federal Statistical Office (Destatis), the total number of companies that applied for insolvency proceedings increased by 28.1% YoY in the first ten months of 2023, increasing from 8,462 in January and October 2022 to 10,837 in January and October 2023. This significant increase in insolvency is expected to affect 1.4 million employees – 123.8% higher YoY than the 61,730 employees affected in the same period of 2022.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

As a whole, Germany’s housing market is likely to be the hardest hit in terms of total economic output, making it the weakest among European housing markets. According to a recent ifo Institute (Leibniz Institute for Economic Research at the University of Munich) survey released in December 2023, residential construction sentiment fell to -56.8 points in December 2023, down from -54.4 points in November 2023 and -54.2 points in October 2023. This marks the lowest level since Ifo began tracking the index in 1991.

However, assuming the removal of obstacles and the implementation of the government’s plan to invest €2 billion in affordable housing construction over the two years to 2026, the residential sector is expected to regain growth momentum in 2025.