In addition to the devastating impact that the intensifying military conflict in Ukraine is having on people’s lives and livelihoods, Russia’s military invasion will also have a severe impact on Ukraine’s economy, with severe disruption to economic activity and the destruction of infrastructure and buildings. The impact on Russia’s economy will also be grave, with international condemnation of Russia’s invasion resulting in sanctions, major disruption to financial systems, the withdrawal of major international companies from their operations in Russia and their dealings with Russian firms, and boycotts of Russian-made goods.

In terms of planned or ongoing construction projects in Russia, although not directly impacted by the military conflict, progress could be impacted by financing issues, if investors or project owners are impacted directly by sanctions or the withdrawal of foreign backers, or because of the sharp contraction in the rouble that could mean projects are no longer viable. There is also the risk of major disruptions in the supply chain.

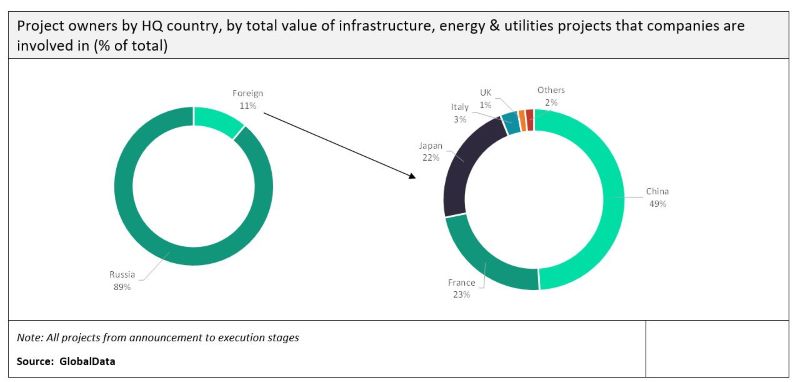

The involvement of foreign direct investors in projects in Russia is low, at just nearly 1% of the the total value of projects. Of the mega projects that GlobalData is tracking in Russia that are currently in execution, Chinese firms are the most heavily involved, but they are only involved in 30 projects out of a total of approximately 2,000 projects being tracked in Russia.

However, there are a small number of major projects that have significant foreign involvement, and among the most notable of these is the $21 billion Arctic LNG-2 project, which is funded by a consortium of Russia’s Novatek (60%), France’s TotalEnergies SE (10%), China’s CNOOC Ltd (10%) and China National Petroleum Corp (10%), and Japan Arctic LNG, a consortium of Japan’s Mitsui (2.5%) and Jogmec (7.5%). When completed (construction works were due to complete in 2023), the LNG project will have a capacity of close to 20 million tonnes per annum. Italy has announced that it will suspend its planned financing of $560 million for the project. Although TotalEnergies has yet to confirm a change in its position in this major project, it has stated that it will no longer provide funding for new developments in Russia.

Other major Chinese firms involved in key projects in Russia include China Petrochemical Corp (Sinopec), which has a stake in the Amur Gas Chemical Complex; China Railway Construction Corp, which is involved in metro projects in Russia; and Huawei, which is involved in the Oblaka Sibiri Data Processing Centre. Although China’s government may try to distance itself from the Russian administration, there are unlikely to be any direct financial and economic action or sanctions that could result in Chinese firms withdrawing their investment.

A number of Western companies have taken action. The British oil company BP has stated that it is exiting its $14 billion stake in Rosneft, a Russian integrated energy company, following Russia’s invasion. Rosneft’s CEO Igor Sechin has also already been hit by EU sanctions. Another major British oil firm, Shell, has also taken action in response to Russia’s invasion of Ukraine, stating that it will pull out of all projects involving Gazprom, the largest Russian majority state-owned multinational energy corporation, including the Sakhalin-2 energy project, a move that will leave Japan’s Mistubishi and Mitsui as the only foreign companies involved in the project. Norway’s Equinor has also stated that it will exit its joint ventures in Russia.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRussian companies’ investments in projects in other countries are heavily centred on power plants and oil and gas facilities, mostly in emerging markets in Eastern Europe and Asia-Pacific. The indirect impact on these projects from Russia’s military action may be limited, particularly if the projects are a critical part of the respective country’s long-term development needs. On 2 March, Hungary’s foreign minister, Peter Szijjarto, stated that Hungary’s government would continue with the project to expand the Paks Nuclear Power Plant, a $14 billion project backed by Russia’s Rosatom (Rosatom State Nuclear Energy Corporation). The project will be equipped with two new Russian-built VVER-1200 reactors, which will have net and gross capacities of 1,114MW and 1,200MW, respectively, such that the plant will produce a total capacity of 4,400MW of power by 2030. The plant currently produces approximately half of Hungary’s electricity.

Russia is also involved in major nuclear power projects in other countries. These include Egypt’s El Dabaa Nuclear Power Plant, Turkey’s Akkuyu Nuclear Power Plant, and Bangladesh’s Rooppur Nuclear Power Plant, all of which are in execution. Russia also has interests in a planned nuclear power project in Nigeria, the Geregu Nuclear Power Plant. This is one of four plants that will be built, operated, and majority-owned by Rosatom. Each plant will cost $20,000m, and their combined generating capacity by 2035 would be 4,800MW. Russia’s involvement in these projects typically includes the financial backing by Rosatom, and contracting work and equipment supplies from Atomstroyexport, which is a wholly owned subsidiary of Rosatom.

In addition to nuclear power projects, Russian firms are involved in oil and gas projects in other markets. Rosneft, for example, is involved in a joint venture with Indonesia’s PT Pertamina (Persero) to construct a crude oil refinery project, Tuban Grass-Root Oil Refinery, in East Java. However, existing and newly planned projects in the oil and gas sector could be hit by decisions by major international firms pulling out of projects, or divesting their shares in Russian companies. Pakistan is also set to continue to work with the Russian government on the $2.0bn Pakistan Stream Gas Pipeline, which involves the construction of a 1,122km LNG pipeline. Pakistan’s Prime Minister Imran Khan held talks in Moscow in late February with Russia’s President Vladimir Putin on this long-delayed gas pipeline, and other economic cooperation.

Lukoil, which is the largest non-state enterprise and has spoken out against Russia’s invasion of Ukraine, has numerous international investments and projects planned. These include the West Qurna Oil Field Development, in Iraq, which is in execution, and some projects in the early stages, including the Pecan Oil Field Development, in Ghana, and the Etinde Gas Condensate Field, in Cameroon. Last year, Lukoil completed several major acquisitions outside Russia, and in February this year it reportedly closed a deal to become a lead shareholder in the Area 4 shallow water assets, in Mexico. Although Lukoil posted high revenues in 2021, of $6.9 billion, its stock price plummeted in later February at the onset of Russia’s invasion of Ukraine, and before the stock market in Russia was closed.