Despite a bleak economic outlook for Europe this year and in 2023 owing to soaring energy and commodity prices, supply disruptions and weakening investor confidence stemming from the war in Ukraine, the hit to construction is expected to be offset partially by the fiscal boost provided by the EU Recovery and Resilience Facility (RRF), a €720bn recovery fund announced in 2020 under the wider NextGenerationEU recovery programme. The programme’s main aim is to aid the post-pandemic economic recovery of EU member states while simultaneously supporting the green and digital transition between 2021 and 2026. The RRF consists of grants (47% of total) and loans (53% of total) available on request to individual member states up to a total of 6.8% of annual GDP.

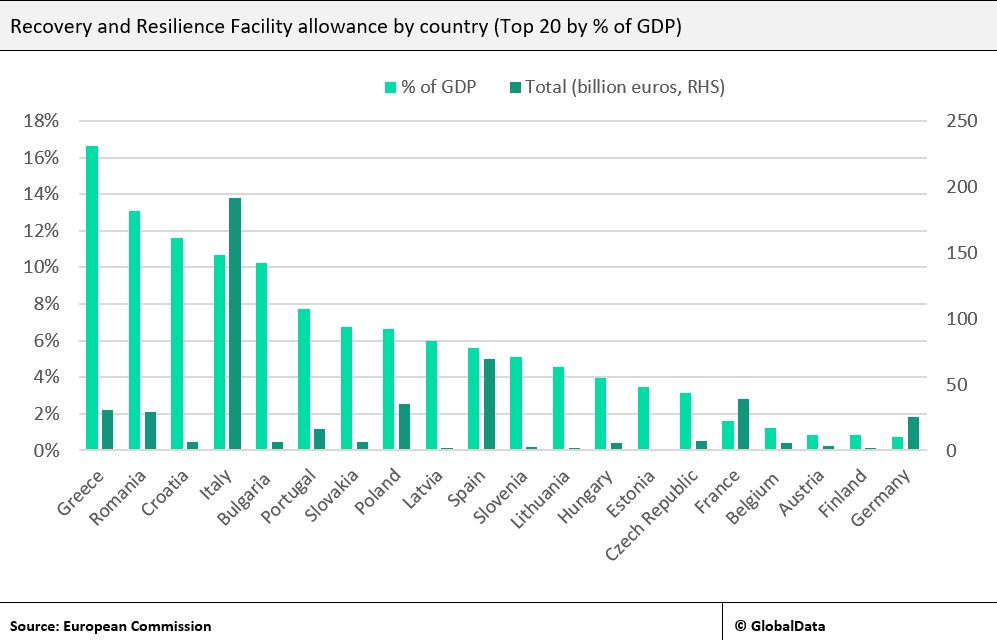

The programme will also help to redistribute capital within the EU, with lower-income countries and those worst hit by the pandemic set to gain the most from it. The RRF allowance (grant plus requested loans) for Greece, Romania, Croatia and Italy amounts to greater than 10% of annual GDP while that for Germany and France amounts to 0.7% and 1.6%, respectively. In the short-term, investment under the RRF is likely to keep the construction industry buoyant while in the long term, it has the potential to converge investment levels across the EU, which will lead to faster growth in industrial expansion and the development of sustainable infrastructure. In addition, its positive macroeconomic impact on low-income countries could accelerate economic growth and raise employment, spurring aggregate demand, which will support the construction of new housing and commercial developments over the long term.

As well as through grants, which will provide a direct fiscal injection, access to RRF loans could boost investment by counteracting the impact of rising government bond spreads across the EU, offering states with high borrowing costs an opportunity to borrow at lower rates through safer NextGenerationEU bonds issued by the European Commission. This has the potential to increase investment in Southern and Eastern Europe and mitigate the risk of rising borrowing costs dampening investment, notable in the previous decade following the eurozone crisis. In Greece, for example, austerity measures taken during the 2010s in response to its sovereign debt crisis led to severe underinvestment in fixed capital over the decade relative to the EU average.

Nevertheless, a significant amount of loanable RRF funds currently remain untapped, with countries such as Spain and Czechia initially reluctant to utilise the loans despite facing high national borrowing costs, opting instead for a wait-and-see approach. The only member states to have utilised the loans so far are Italy, Greece and Slovakia, which have requested their total maximum allowance, and Poland and Portugal, which have requested 35% and 19% of their allowance, respectively. However, rising interest rates and widening bond spreads are likely to encourage greater take up of RRF loans over the coming quarters.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData