Egypt’s economy – which was hit by the successive impacts of the coronavirus (Covid-19) pandemic and the Russia-Ukraine war over the past few years – is currently witnessing its most severe economic crisis since the 2011 revolution.

The country is experiencing a weak currency, soaring inflation, foreign exchange shortage, and a deepening debt crisis.

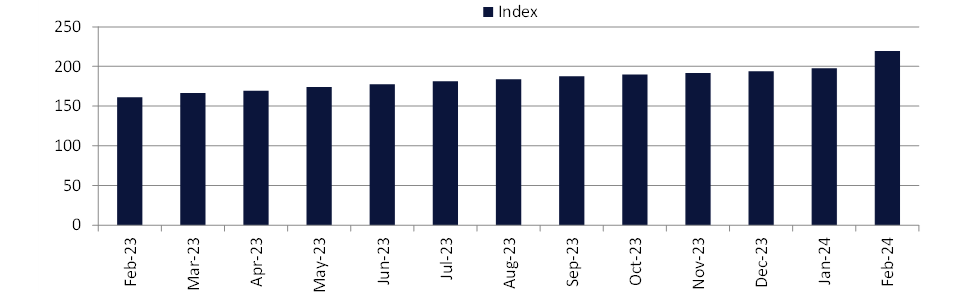

According to the Central Agency for Public Mobilization and Statistics, Egypt’s annual headline inflation reached a record-high level of 219.4 points in February 2024, marking an annual rate of 36% that month; this compares to 197.6 points (a rate of 31.2%) in January 2024.

The government is focusing on combating inflationary pressures and attracting foreign investment to the country, amid a shortage of foreign currency. To battle the surging inflation, the Central Bank of Egypt (CBE) hiked its key interest rate by 600 basis points to 27.75%, in early March 2024.

Similarly, the overnight deposit and lending rates were also raised by 600 basis points to 27.25% and 28.25% respectively, in the same month.

Since March 2022, the CBE has hiked key interest rates by a combined total of 19% (1,900 basis points), 8% of which was applied in February and March 2024 alone.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEconomic output in Egypt is expected to be further affected by the Israel-Hamas war and the spiralling tensions in the Red Sea.

According to the Suez Canal Authority, the number of ships navigating the Suez Canal – which is a key source of revenue for Egypt – fell by 36% year-on-year (YoY) in January 2024, as attacks by the Yemeni militants on Red Sea vessels forced major shipping companies to avoid the waterway.

As a result, Egypt’s Suez Canal revenue fell by 46.8% YoY, from E£34bn ($804m) in January 2023 to E£18.1bn in January 2024.

The fall in Suez Canal revenue is likely to further worsen the country’s foreign currency shortage.

The shortage had started during the time of the Covid-19 pandemic, amid a fall in tourism activities, with the shortage exacerbating further due to a rise in oil and wheat prices following the Russian invasion of Ukraine in 2022.

Apart from hiking interest rates by 600 basis points in early March 2024, the CBE had also agreed to slow down infrastructure spending and allow the Egyptian pound’s value to plummet, in exchange for a loan package from the International Monetary Fund (IMF).

In late March 2024, the IMF increased its bailout loan to Egypt from E£126.9bn to E£338.5bn; this will enable the country to immediately receive approximately E£34.7bn in funding.

This deal was achieved after Egypt agreed with the IMF on a reform plan that is centred on floating the local currency, reducing public investment, and allowing the private sector to become the engine of growth.

The government has allowed the Egyptian pound to weaken by close to 40% against the US dollar – marking its deepest devaluation in a decade.

Following the IMF’s deal, the US-based financial services company Moody’s reversed Egypt’s sovereign rating outlook from negative to positive, in early March 2024.

Additionally, the Egyptian government has been receiving financial assistance from regional sponsors and international financial bodies, to alleviate the country’s economic and financial woes.

In less than three weeks, the government secured financial assistance worth more than E£2.3trn in the form of loans, grants, and investments, as of mid-March 2024.

Furthermore, in March 2024, the EU announced a funding package of E£330bn to Egypt for the period of 2024 to 2027.

The package will be provided in the form of E£224.2bn in macro-financial assistance, E£80.4bn in investments, and E£269bn in grants.

The funding will help Egypt stabilise its economy, reducing its dependence on Russian gas, and addressing the issue of migration.

Moreover, the World Bank announced, in mid-March 2024, that it will provide more than E£253.8bn of financial support to Egypt over the next three years.

Of the total, 50% of the funding will be provided for the government’s programmes and the remaining 50% for the private sector.

The World Bank’s programmes will focus on increasing opportunities for private-sector participation, strengthening the governance of state-owned enterprises, and improving the efficiency of public resource management.

The Egyptian cabinet approved the country’s E£6.4trn budget for financial year 2024-25 (FY24-25) in late March 2024.

As part of the latest budget, the government announced its intentions to kerb public spending, in order to tackle the country’s mounting debt.

For the first time, the government set a spending cap of E£1trn for public investment in FY24-25.

This measure is a part of the government’s broader target to gradually reduce the country’s debt-to-gross domestic product ratio, with a target of reaching 80% by 2027.

According to the country’s minister of finance, the purpose of the new investment cap is to create more opportunities for the private sector.

The minister also reported that all investment projects undertaken by state-owned entities will be subject to this cap.

The fall in Egypt’s Suez Canal revenues, coupled with the government’s focus on managing budget deficit, and limiting public investments is likely to weigh on the progress of certain non-essential projects, thereby weighing on the Egyptian construction industry’s growth in 2024.