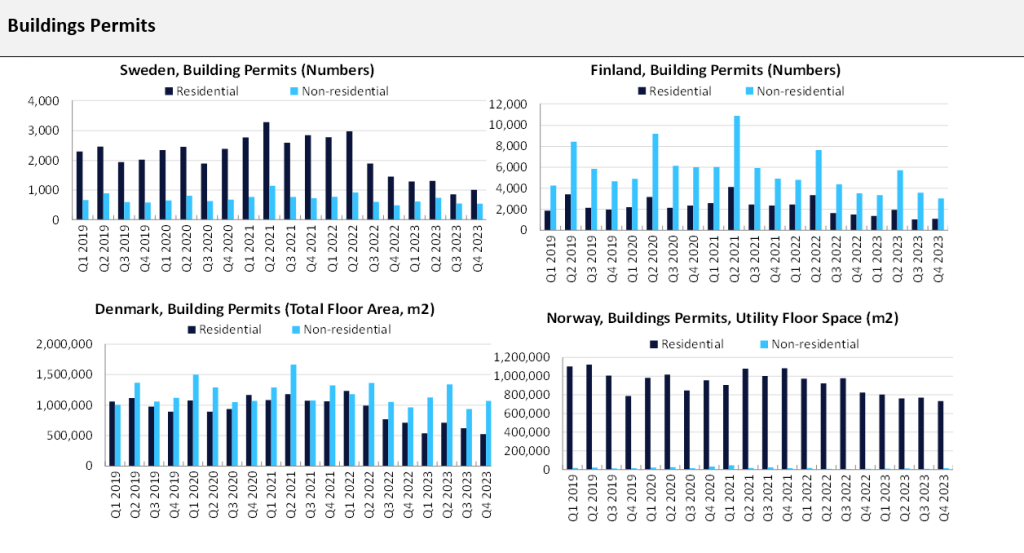

The construction industry in the Nordic countries (Denmark, Sweden, Finland and Norway) suffered from multiple headwinds owing to high interest rates, construction material costs, and supply chain disruptions. A major reason behind the gloomy construction scenario is the sharp decline in the residential segment, with building permits declining sharply in 2023. Despite this, the construction industry has not declined as sharply as expected owing to a lag between the decline in building permits hitting output levels. The Finnish construction industry declined by 8.7% in 2023 while the Swedish and Norwegian construction industries contracted by 5.8% and 2.1% respectively. On the other hand, the Danish construction industry grew marginally by 1.9% in 2023. The residential construction sector contributes the most in the Swedish construction industry, accounting for a 43.9% share in 2023, while in Denmark, Norway and Finland, residential construction accounted for 43.1%, 38% and 32.1% respectively in 2023. Despite the decline in residential building permit data, the construction industry in Nordic countries in 2023 has not been affected as adversely as the building permit data, supported by ongoing work on transport and renewable energy infrastructure projects.

The weakness in the construction industry is largely due to sluggishness in the residential construction sector which contributes the most in the Finnish construction industry (32.1% in 2023). The residential construction sector is expected to shrink by 10.3% in 2024, due to rising construction costs, high interest rates, and weak investor and consumer confidence, leading to the cancellation of housing projects and bankruptcies. According to Statistics Finland, the total number of building permits issued in the country fell by 17.9% in Q4 2023, preceded by a year-on-year (YoY) decline of 23.6% in Q3 and 30.2% in Q2 2023. Cumulatively, the total number of building permits issued declined by 28% YoY in 2023, within which the number of residential building permits issued contracted by 39.5% YoY during the same period.

Finland, Building Permits (Numbers), % Change, YoY

According to the Statistiska Central Byrån (SCB), the total number of building permits approved in Sweden fell by 20.3% in Q4 2023, preceded by YoY decline of 43.9% in Q3 and 47.3% in Q2 2023. Annually, the total number of building permits approved declined by 41.9% YoY in 2023, with the total number of residential building permits issued falling by 50.9% YoY during the same period.

Sweden, Building Permits (Numbers), % Change, YoY

Norway, Buildings Permits (Utility Floor Space, m²), % Change, YoY

Despite the Danish construction output recording positive growth in 2023, the outlook for the near term remains gloomy. This reflects the recent sharp fall in the total floor area of permits awarded for residential and non-residential buildings in Denmark in 2023. Total permits issued, in terms of square metres (m²) of useful floor area, fell by 4.7% in Q4 2023, preceded by YoY decline of 14.4% in Q3 and 13% in Q2 2023, according to Statistics Denmark. Cumulatively, the total floor area of building permits issued declined by 16.9% YoY in 2023, with residential building permits falling by 35.4% YoY during the same period.

Denmark, Building Permits (Total Floor Area, m²), % Change, YoY

Reflecting the current weakness in the residential sector, GlobalData expects the Danish construction industry to contract by 6.9% in 2024, whereas the Swedish construction industry by 6.1%, the Finnish construction industry by 5.1% and Norway’s construction industry by 3% during the same period, with the high likelihood of further declines if activity in the short-term is more severely disrupted than currently anticipated. However, over the long term, the construction industry in the Nordic countries will recover, supported by investments in transport, and energy infrastructure projects. Under the National Transport System Plan for 2021–2032, the Finnish Government plans to spend $6.2bn to upgrade the country’s transport infrastructure over 12 years. Under the National Plan for Transport Infrastructure 2022–2033, the Swedish government will be investing $94.6bn in railway and road development. Moreover, the Swedish Government aims to achieve 100% renewable electricity by 2040 and increase wind-generated electricity from 27.4TWh in 2021 to 46.9TWh in 2024, with a long-term goal of 70TWh-90TWh by 2040. The Danish Government has a target to reduce greenhouse gas emissions by 70% compared to 1990 levels by 2030 and reach net zero emissions by 2050; this will attract investments towards energy projects. The Norwegian Government too is focusing on the development of renewable energy infrastructure specially the wind energy infrastructure in line with the country’s target of reaching net zero carbon emissions by 2030 compared to 1991 levels. In January 2023, the Norwegian Government announced plans to develop 30GW of offshore wind capacity by 2040.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData