Disruptions and Shortages in the Construction Industry

The global construction industry has been recovering from the severe disruption caused by the COVID-19 pandemic. However, it continues to confront major challenges. Shortages of key materials and associated rising prices for such materials have impacted on the progress of construction projects, while logistical hold-ups along with supply chain disruptions are extending lead times. The combination of these factors means that contractors are finding it increasingly difficult to complete projects on time and on budget. Many of these challenges were already apparent in 2021, but in recent months have been exacerbated by Russia’s invasion of Ukraine, which has resulted in a further surge in energy costs as well as disruptions in the supply of vital materials, including steel.

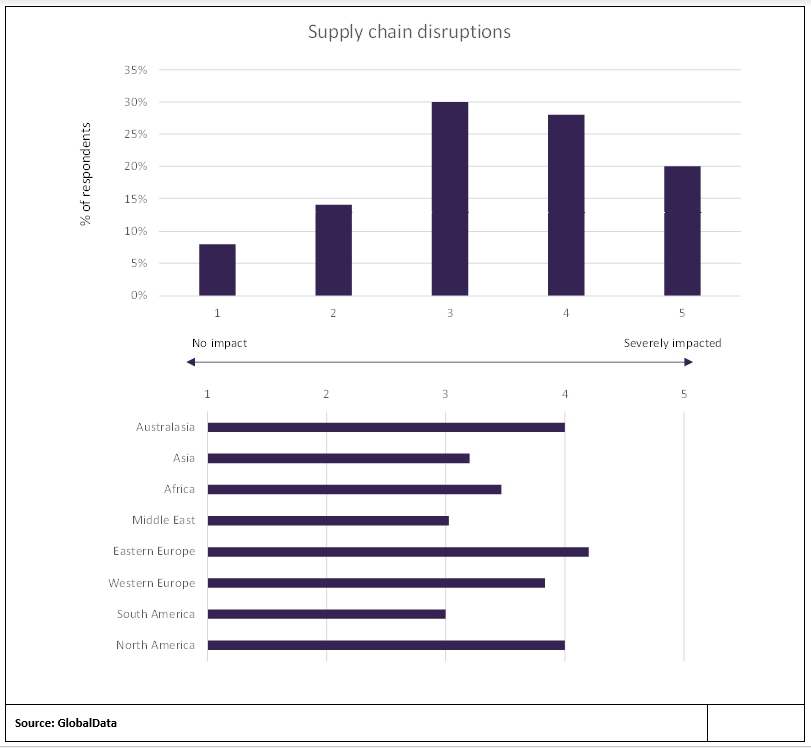

According to a GlobalData survey carried out in June 2022, a high proportion of respondents stated that they had been impacted to a significant extent by supply chain disruptions. On a scale of 1 to 5, with 1 indicating that they have not suffered any impact from supply chain disruptions, and 5 indicating that they had been severely disrupted, 48% responded with a 4 or 5, and 30% with a 3. The most severe disruption was recorded in Eastern Europe, with a weighted average of 4.2, which was slightly higher than in Australasia and North America.

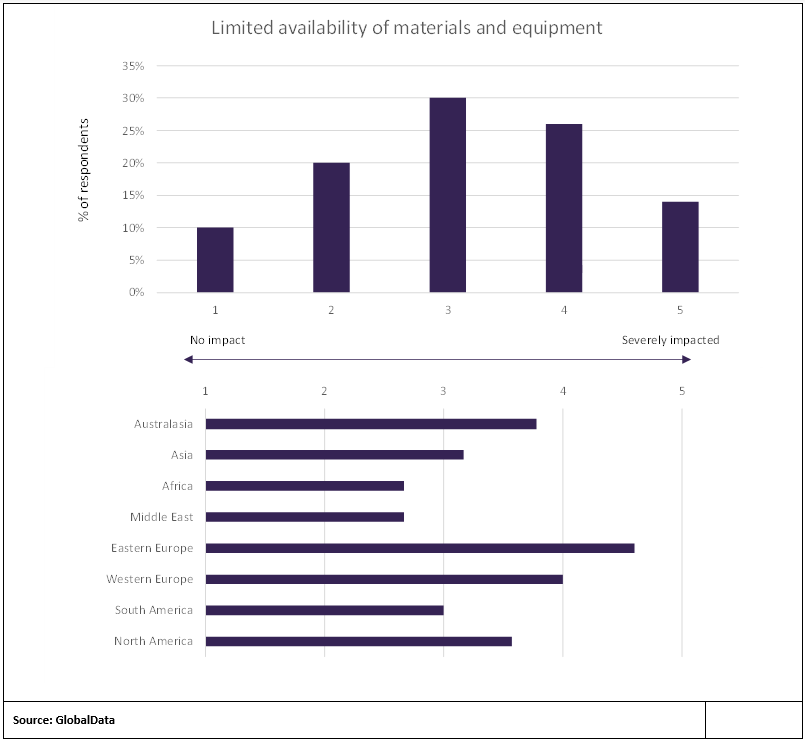

Linked to the supply chain disruptions that have been experienced, contractors have raised concerns over limited availability of materials and equipment. This had been a significant issue during 2021, as production levels were ramped up following the severe disruption to activity throughout 2020 amid restrictions imposed to contain COVID-19. However, the improvement in supplies has generally insufficient to meet the surge in demand. Lumber prices have been particularly volatile reflecting shortages in supply, while the steel industry is expected to face new challenges and supply chain issues amid the conflict in Ukraine.

Disruption caused by material shortages has been exacerbated by the imposition of Western sanctions restricted trade flows between Europe and Russia, which is a major exporter of energy and raw materials used in production. According to data from the European Steel Association (EUROFER), of the EU’s flat product imports in 2020, Russia accounted for 14% and Ukraine for 8%, and Russia was the leading supplier of long products, accounting for 19% of the total, and Ukraine supplied just over 7%.

In the recent industry survey, on the scale of 1-5, with 5 reflecting that respondents had been severely impacted by limited availability of materials and equipment, 40% of respondents replied with a 4 or 5, and 30% with a 3. Unsurprisingly, given the disruption caused by Russia’s invasion of Ukraine, the most severely impacted region has been Eastern Europe, with an average response of 4.6, ahead of Western Europe with 4.0, and then Australasia (3.8%) and North America (3.6).

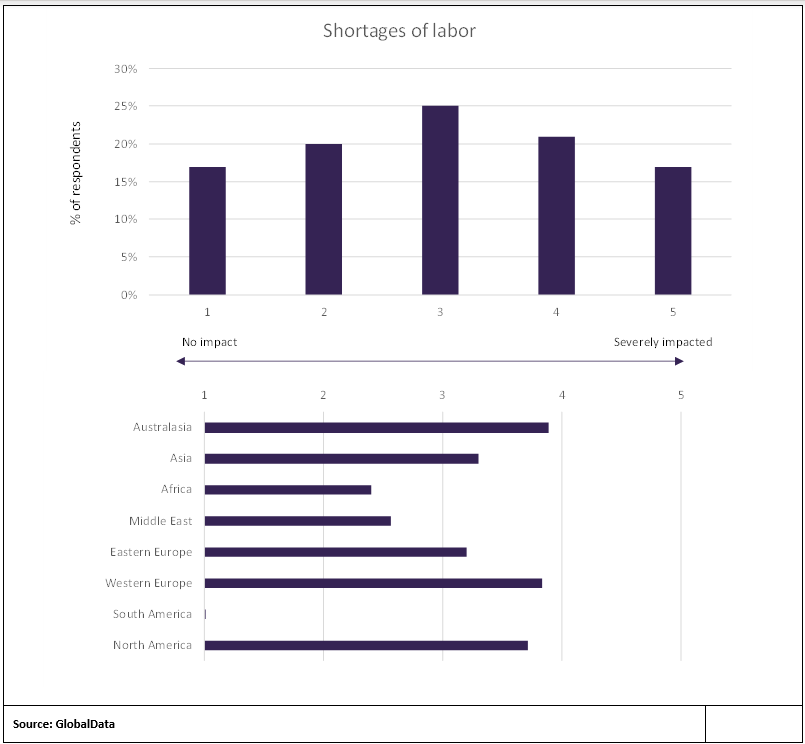

In addition to supply chain disruptions, the construction industry has also generally been struggling to recruit labor to meet requirements. The shutdown of the construction industry in many major markets in 2020 and also during periods in 2021 resulted in a sharp decline in construction employment, and there have been difficulties in recruiting talent as construction activity bounced back. Prior to the COVID-19 crisis there had already been concerns about the ageing construction workforce and the looming challenge of ensuring that retiring skilled workers would be replaced. The reliance in many markets on immigrant labor has also been exposed in the wake of the COVID-19 crisis with a proportion of this workforce not returning to their previous locations.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHowever, the range of responses in the survey to the question of the severity of the impact of shortages of labor suggest that this is not as significant as the impact of materials and equipment shortages. In total, 38% of respondents replied with a 4 or 5, and 25% with a 3. The results also suggest that the impact has been most significant in the advanced economic regions, of Australasia, Western Europe and North America.