The Brazilian construction industry remained weak in March 2023, with a decline in activity and employment for the fifth consecutive month. However, the latest data suggests that the decline in activity was not intense and widespread. Additionally, the drop in activity from February to March 2023 is the least intense in the sequence of declines that started in November 2022.

The decline in activity is attributed to high energy and construction material prices, and surging inflationary pressures, coupled with high levels of interest rates, lower levels of demand, and high household debt.

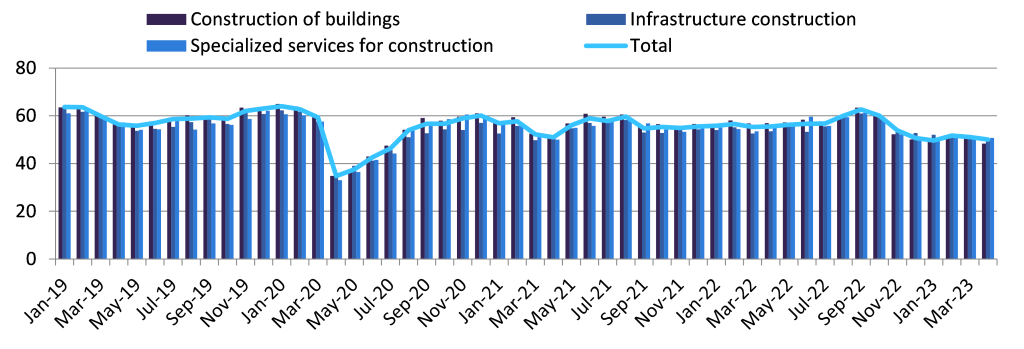

According to the latest Construction Industry Survey published by the National Confederation of Industry (CNI) with the support of the Brazilian Chamber of Construction Industry (CBIC), the construction activity index reached 49.5 in March 2023, marking the fifth consecutive month with a score below 50. This was preceded by scores of 47.6 in February and 45.9 in January 2023.

Values below 50 points indicate a decline in activity compared to the previous month, while values above 50 indicate an increase in activity compared to the previous month.

Infrastructure construction work registered a score of 47.4 in March 2023, whereas building construction work registered a score of 47.9 during the same period. The average construction activity index score was 46.7 in January-March 2023. In terms of segmentation, construction of buildings, specialised services for construction and infrastructure construction posted scores of 46.8, 44.3 and 46.9 in the first three months of 2023, respectively.

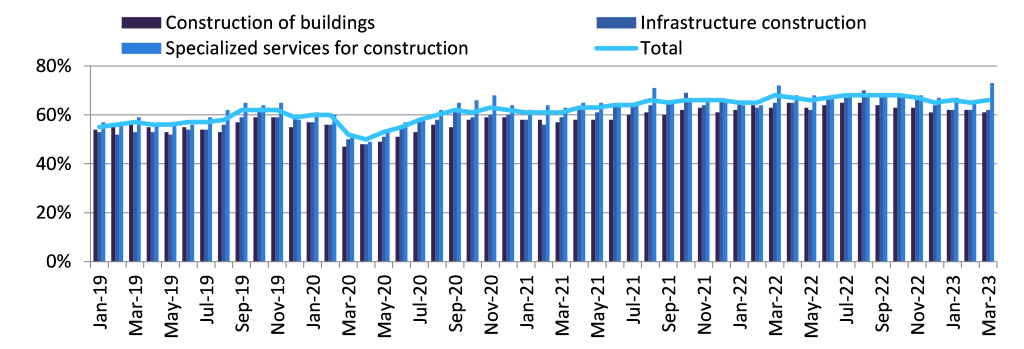

Brazil’s business confidence indicator (ICEI) in the construction industry also deteriorated in the first four months of 2023, dropping to 50 in April 2023, compared with scores of 51.1 in March, 51.7 in February and 49.6 in January 2023, according to the CNI. The average confidence score declined from 55.8 in January-April 2022 to 50.6 in January-April 2023.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn terms of segmentation, the confidence score declined for the construction of buildings, from 57.1 to 50.2, and for specialised services for construction from 54.7 to 50.7, and for infrastructure construction from 53.8 to 51 during the same period. The 50-point mark is the dividing line between an indication that industry entrepreneurs are confident in the industry’s prospects for growth (scores above 50) or lack confidence (scores below 50).

Brazil, ICEI

Operational capacity utilisation in the construction industry also remained weak in March 2023 compared to 2022. According to the CNI, the utilisation of operational capacity in the construction industry reached 66% in March 2023, compared to 65% in February and 66% in January 2023.

In cumulative terms, the average utilisation of operational capacity in the industry declined marginally from 66% during January-March 2022 to 65.7% during January-March 2023. In terms of segmentation, it declined from 63% to 62% for the construction of buildings and fell from 64% to 62% for infrastructure construction, however it rose from 67% to 69% for specialised services for construction during the same period.

Brazil, construction – operation capacity utilisation

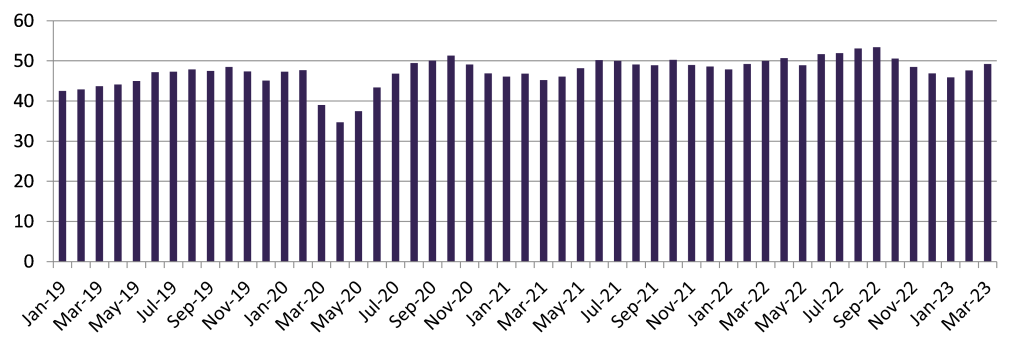

The average index for the number of employees in the construction industry also declined in March 2023, the fifth consecutive decline since November 2022. According to the CNI, the index of the evolution of the number of employees in the construction industry reached 49.2 points in March 2023 and 47.6 in February 2023.

The fall in employment was the least intense and widespread in March in the five-month interval in which there was a decline. The index varies from 0 to 100, with an index score above 50 indicating growth and below a decline. In cumulative terms, the average index of the evolution of the number of employees in the construction industry decreased from 49 during January-March 2022 to 47.6 during January-March 2023.

Brazil, index of evolution of the number of employees in construction

Despite the high inflation and interest rates and a rise in construction material prices, construction entrepreneurs’ expectations are finely balanced in terms of growth prospects. GlobalData expects Brazil’s construction industry to expand by just 2.7% in real terms in 2023, down from 6.9% recorded last year and 10.0% in 2021. The outlook is subject to downside risks, but construction activity will be supported by investment in transport, energy, and housing projects.

The government has set a target to increase the share of rail in the total freight transported from 21.7% in 2017 to 35% by 2035, under the ‘Pro Trilhos‘ (Pro Rail) programme. As part of this programme, in February 2023, the National Land Transport Agency authorised the rail service company, TAV Brasil for the construction of the Rio-Sao Paulo railway line between Rio de Janeiro and São Paulo. With a total valuation of 50 billion reais, the company is expected to complete the construction works of a rail network of 380km by the end of 2031.

In addition to this, the government is developing the Casa Verde e Amarela Housing programme for serving 1.6 million low-income families with housing financing and improvements in around 400,000 homes by the end of 2024. In February 2023, President Lula announced that the government is improving the Minha Casa Minha Vida Phase III programme, which involves the construction of two million low-income housing units in urban and rural areas by the end of 2023.