The Brazilian construction industry continued to perform on a positive note in April 2022, as is evident in newly released data showing that the construction activity and average employment level in the first four months of 2022 reached the highest levels since 2012. Moreover, the construction industry’s value add remained strong in the first quarter of 2022 and posted a growth of 9% year-on-year (YoY) that quarter; preceded by YoY growth of 12.2% in Q4 and 10.9% in Q3 2021, according to the Brazilian Institute of Geography and Statistics (IBGE).

According to the latest Construction Industry Survey published by the National Confederation of Industry (CNI), with the support of the Brazilian Chamber of Construction Industry (CBIC), the construction activity index reached 50.1 in April 2022, marking the second consecutive month with a score above 50. Values above 50 indicate an increase in activity compared to the previous month while values below 50 points indicate a decline in activity compared to the previous month. Building construction work remained positive in April 2022, with index registering score of 51.9 that month, compared to 53 in March and 50.5 in February 2022. In cumulative terms, the average construction activity index posted a score of 49.3 during January-April 2022, which was up from a score of 45.8 during the same period of last year. In terms of segmentation, construction of buildings, specialised services for construction, and infrastructure construction posted scores of 51.1, 49.2 and 45.2 in the first four months of 2022, respectively.

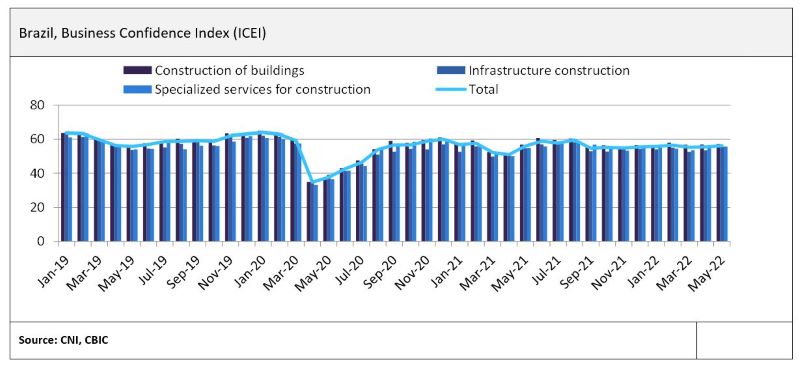

Brazil’s business confidence indicator (ICEI) in the construction industry also improved in the first five months of 2022, rising to 56.2 in May 2022, up from scores of 55.5 in April and 55.3 in March 2022, according to the CNI. In cumulative terms, the average ICEI grew by 2% YoY in the first five months of this year, increasing from 54.8 during January-May 2021 to 55.9 during January–May 2022. In terms of segmentation, for the construction of buildings, the index rose from 55.6 to 57.1, and for infrastructure construction from 52.7 to 54.2, and for specialised services for construction from 54.2 to 54.9 during the same period.

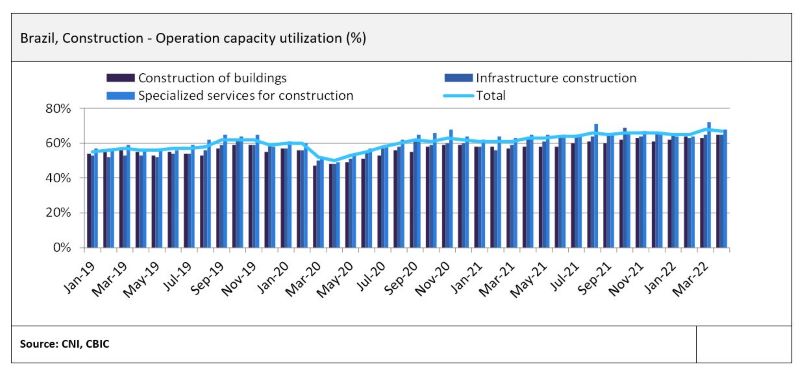

Moreover, operational capacity utilisation in the construction industry remained stable in April compared to March 2022. According to the CNI, the utilisation of operational capacity in the construction industry reached 67% in April 2022, compared to 68% in March, and 65% each in February and January 2022. In cumulative terms, the average utilisation of operational capacity in the industry grew from 61.5% during January-April 2021 to 66.3% during January-April 2022. In terms of segmentation, it grew from 57.8% to 63.5% for the construction of buildings while it increased from 59% to 64.5% for infrastructure construction and from 63.5% to 67% for specialised services for construction during the same period.

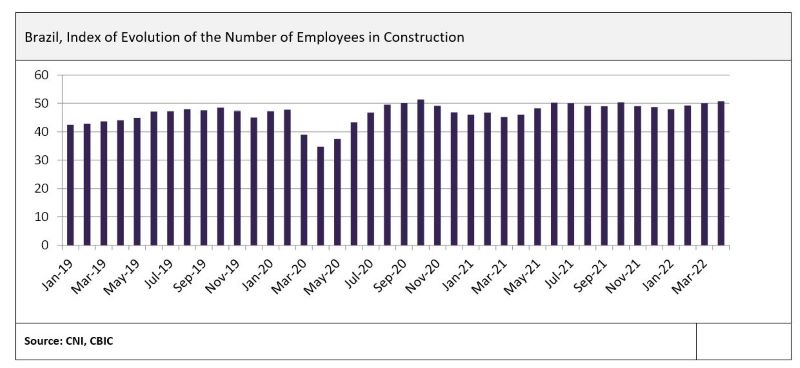

The average index for the number of employees in the construction industry in the first four months of 2022 were the highest for the period since 2012. According to the CNI, the index of evolution of the number of employees in the construction industry reached to 50.7 points in April and 50 in March 2022. The index varies from 0 to 100, with cut line at 50 points; the index above this value indicate growth, and below shows decline. In cumulative terms, the average index of evolution of the number of employees in construction industry increased from 46.1 during January-April 2021 to 49.5 during January-April 2022.

Despite the surging inflation and a rise in construction material prices, investor appetite for infrastructure projects remains strong. The federal government launched the Construa Brasil project in April 2022, in order to improve the business environment in the civil construction industry, remove current barriers, and encourage the modernisation of companies. GlobalData expects Brazil’s construction industry to expand by 2.6% in real terms in 2022, and record an annual average growth rate of 2.6% over the remainder of the forecast period (2023–26), supported by investments in the transport, electricity, housing, and telecommunications sectors. The industry’s growth in 2022 will be supported by progress on works that have already been contracted, especially due to an increase in public and private investments in the transport and logistics infrastructure sectors.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn May 2021, Brazil’s infrastructure minister said that he expects a R$267.8 billion ($50 billion) investment boom in the development and modernisation of the country’s roads, rail, airports, and ports by 2022, driven by concession projects. As part of the Pro Trilhos railway program, the State Government of Minas Gerais signed protocols of intent with two companies in April 2022. The companies will now invest R$38.6 billion ($7.2 billion) on constructing four railway links that connect the states of Minas Gerais and Espírito Santo.