The construction industry in Australia is estimated to have expanded by 7.8% in real terms in 2023, supported by a sharp rise in engineering construction activity.

The industry is, however, projected to contract by 0.2% in real terms in 2024, with a

decline in residential construction output expected following a sustained decline in residential building approvals.

Rising insolvencies in the construction industry will further weigh on the industry’s output in 2024.

According to the Australian Securities and Investments Commission, the total number of building companies in the country that have entered administration

rose by 31% last year, increasing from 1,793 in 2022 to 2,349 in 2023.

The residential construction sector is estimated to shrink by 6.7% in real terms in 2024, owing to headwinds caused by high material costs, elevated interest rates, and rising insolvencies amongst developers.

In early October 2023, Reserve Bank of Australia reported that one in three large homebuilders was experiencing negative cash flows as rapidly rising wages and material costs led to a surge in insolvencies; this compares to a rate of just 12% in March 2021.

In mid-September 2023, South Australia-based developer Qattro was placed into liquidation, with the company announcing that supply chain issues and labour shortages have caused blow-outs to fixed-price construction contracts.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe company’s collapse left more than 200 projects in limbo; these projects were collectively worth more than A110m ($76m) and were in the execution or pre-execution stages.

Other companies that went into liquidation in recent months include Sydney-based builder Toplace (July 2023), South Australia-based builder Felmeri Homes (May 2023), and Victoria-based builder Porter Davis (March 2023).

A fall in major indicators such as housing starts, dwelling approvals, loans for the construction or purchase of new homes, and new home sales suggest that activity in the residential sector will decline in 2024.

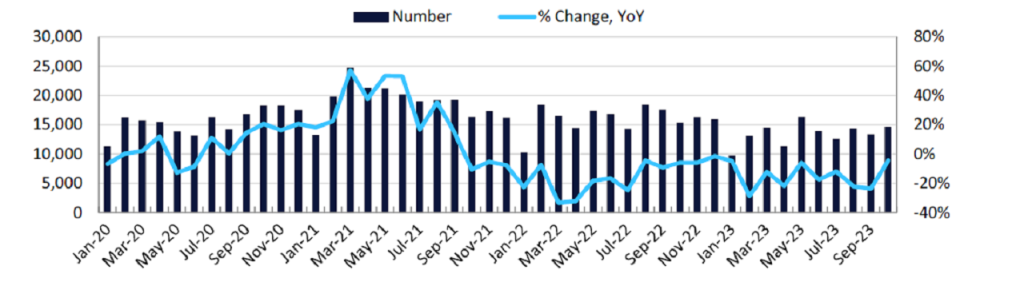

According to the Australian Bureau of Statistics (ABS), the total number of dwelling units approved fell by 4.4% year-on-year (YoY) in October 2023, following YoY falls of 23.6% in September and 22.1% in August 2023.

Cumulatively, dwelling approvals fell by 15.9% YoY in the first ten months of 2023,

declining from 159,428 units in January-October 2022 to 134,002 units in January-October 2023.

During this period, the majority of units approved were in Victoria (31.1%), followed by New South Wales (28.1%), Queensland (20.8%), and Western Australia (8.5%).

In August 2023, the government announced a five-year target to construct 1.2 million new dwellings, beginning from financial year 2024-25 (FY24-25, starting in July 2024).

The government plans to ease planning and zoning laws to attract greater

participation from private-sector developers.

To achieve this target, an average of 240,000 homes must be built every year,

until FY28-29.

This target is, however, unlikely to be achieved against a backdrop of labour shortages, elevated materials costs, high interest rates, and rising builder failures.

Moreover, only approximately 134,000 dwellings were approved in the first ten

months of 2023, with private sector approvals – which accounted for 98.2% of total approvals – falling by 15.6% YoY during that period.

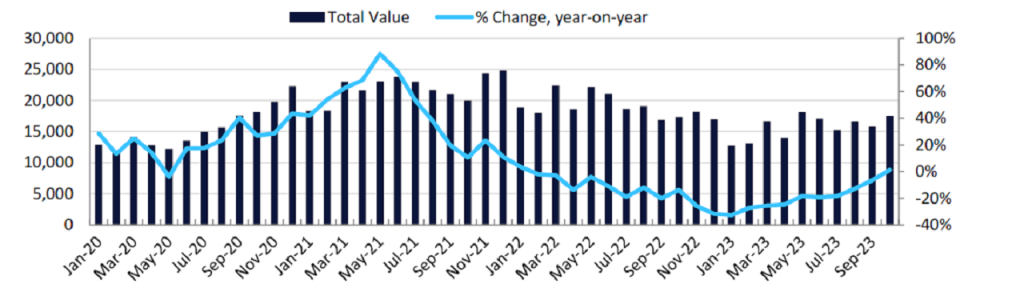

The latest data on loans for the purchase and construction of new homes indicate a further headwind to the government’s target.

According to the ABS, the total value of owner-occupier new loan commitments for households (excluding refinancing) fell by 18.8% YoY in the first ten months of 2023; by segment, the value of loan commitments for the construction of dwellings fell by 29.4% YoY, for the purchase of residential land declined by 19.6% YoY, for the purchase of existing dwellings fell by 17.6% YoY, for the purchase of newly erected dwellings fell by 16.6% YoY, and for alterations, additions, and repairs declined by 12% YoY during the first ten months of 2023.

The A$10bn ($6.9bn) Housing Australia Future Fund (HAFF), which was established in November 2023, will however provide some support for the residential sector’s growth over the coming years.

The HAFF will provide funding to support and increase the construction of social and affordable housing and provide finance for other acute housing needs

such as that for Indigenous Australian communities and housing services for women, children, and veterans.

The fund is projected to help deliver 30,000 new social and affordable rental homes in its first five years.