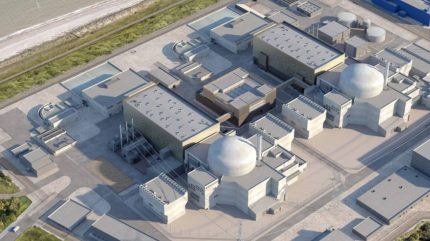

The UK government has finalised its investment decision for the £38bn ($51.4bn) Sizewell C nuclear power plant in Suffolk, England.

The project is expected to generate clean energy for six million homes and create 10,000 jobs once operational.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The approval of Sizewell C marks a strategic move to secure Britain’s nuclear energy supply beyond 2030, aligning with the government’s objective to reduce dependency on fossil fuels.

Sizewell C is projected to provide affordable clean electricity for at least 60 years. Analysis indicates potential savings of £2bn annually in the future low-carbon electricity system, benefiting consumers with reduced energy costs.

The project is also set to stimulate economic growth, with 10,000 direct jobs generated at peak construction and thousands more in the supply chain.

Additionally, 1,500 apprenticeships will be created, and 70% of the construction value is expected to be awarded to British businesses, with Sizewell C planning to engage 3,500 UK companies nationwide.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataUK Secretary of State for Energy Security and Net Zero Ed Miliband said: “It is time to do big things and build big projects in this country again – and today we announce an investment that will provide clean, homegrown power to millions of homes for generations to come.

“This government is making the investment needed to deliver a new golden age of nuclear, so we can end delays and free us from the ravages of the global fossil-fuel markets to bring bills down for good.”

The government will initially hold a 44.9% stake, becoming the largest equity shareholder, ensuring public benefit from the investment. Other shareholders will include La Caisse with 20%, Centrica with 15%, and Amber Infrastructure with 7.6%.

EDF, a French energy company, has a 12.5% stake, supported by a proposed £5bn debt guarantee from France’s Bpifrance Assurance Export.

The National Wealth Fund, the UK government’s main investor, is making its first investment in nuclear energy, providing most of the project’s debt finance alongside Bpifrance.

The investment strategy for Sizewell C draws on lessons from Hinkley Point C, offering a funding model that distributes the £38bn construction cost among consumers, taxpayers, and private investors. This approach reportedly results in a 20% cost saving compared to Hinkley Point C.

British citizens will co-own the plant with private partners, ensuring minimal impact on consumer bills, averaging around £1 per month during construction, with the plant seemingly delivering cheaper clean energy once operational.

Sizewell C joint managing directors Julia Pyke and Nigel Cann said: “We’re delighted to welcome new investors alongside government and EDF who, like our suppliers, have strong incentives to keep costs under control and ensure we deliver Sizewell C successfully for consumers and taxpayers.

“By investing in Sizewell C, they are laying the foundations for a more secure, cleaner and more affordable energy system.

“Because 70% of our construction spend will be in the UK, with a £4.4bn commitment to the east of England, they will also help to create thousands of great jobs and new opportunities for people and businesses up and down the country.”