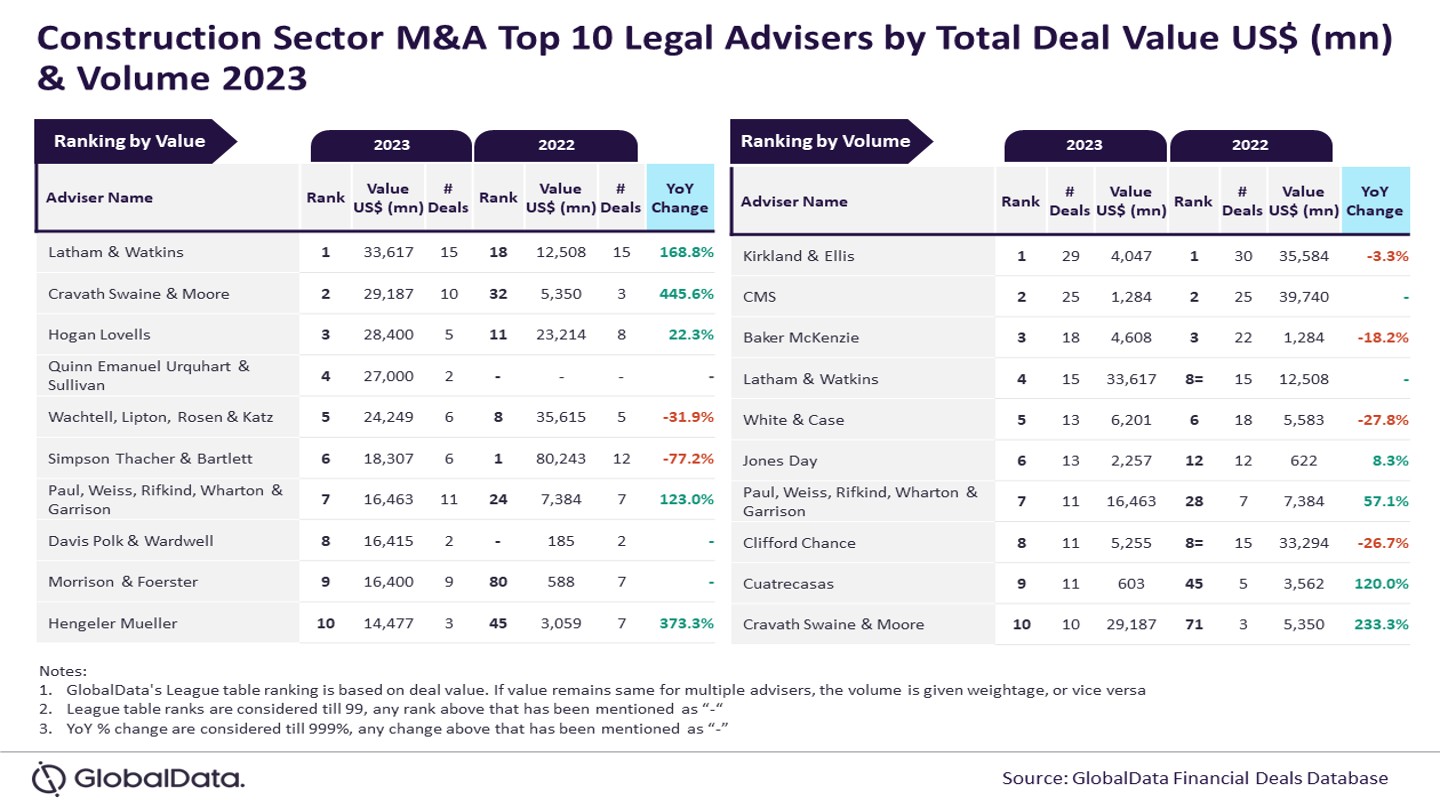

Latham & Watkins and Kirkland & Ellis have emerged as the top mergers and acquisitions (M&A) legal advisers in the construction sector for 2023, by value and volume, respectively, according to the latest league table released by GlobalData, a leading data and analytics company.

GlobalData, a leading data and analytics company and the parent of World Construction Network, ranks advisers in terms of the value and volume of M&A deals on which they advised.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

According to GlobalData’s deals database, Latham & Watkins secured the top position by value, advising on deals worth $33.6bn while Kirkland & Ellis led by volume, with a total of 29 deals under its advisory.

GlobalData lead analyst Aurojyoti Bose said: “Kirkland & Ellis was the top adviser by volume in 2022 and managed to retain its leadership position by this metric in 2023 as well.

“Meanwhile, Latham & Watkins registered a significant improvement in its ranking by value from 18th position in 2022 to top the chart in 2023, driven by its involvement in big-ticket deals. It advised on $6bn deals in 2023 that also included a megadeal valued more than $10bn.”

Cravath Swaine & Moore ranked second in terms of value, by advising on deals worth $29.2bn followed by Hogan Lovells at $28.4bn, Quinn Emanuel Urquhart & Sullivan at $27bn, and Wachtell, Lipton, Rosen & Katz, at $24.2bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn terms of deal volume, CMS came in second with 25 deals, followed by Baker McKenzie with 18 deals, Latham & Watkins at 15 deals, and White & Case with 13 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory businesses, and other reliable sources available via the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure the further robustness of its data, the company also seeks submissions of deals from leading advisers.