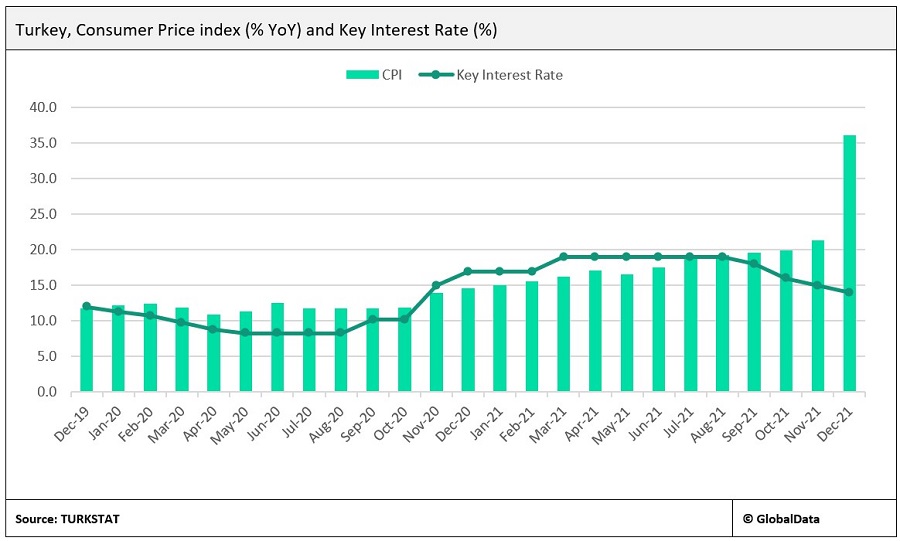

Inflation in Turkey spiralled last month as the Consumer Price Index (CPI) rose by 36.1% year-on-year (YoY), up from 21.3% in November. This sharp rise in inflation is largely attributable to the Central Bank of Turkey’s decision to cut the interest rate incrementally by 5% from September to December, despite fears of rising inflation following high levels of government spending to support the economy through the Covid-19 pandemic. At the end of the third quarter (Q3) of 2021, the key interest rate stood at 19%, and it had been cut to 14% by the end of the fourth quarter (Q4).

Turkey also runs a large current account deficit and relies heavily on foreign capital inflows. The central bank’s decision to cut rates has led to a fall in foreign demand for Turkish assets, including the lira, and has exacerbated Turkey’s ongoing currency crisis. As a result of this policy, the value of the lira fell by 33.5% quarter-on-quarter (QoQ) against the US dollar in Q4 2021. On 20 December, President Recep Tayyip Erdogan – who influenced the central bank’s decision to cut rates – announced a plan to protect Turkish depositors against the lira’s volatility following the rapid depreciation of the currency in Q4 2021. On the back of this announcement, the lira appreciated by 20.7% against the US dollar and stabilised around TRY13.6:USD1 in early January, signalling greater confidence in the currency and stabilisation of the economy going into the new year.

Despite this, President Erdogan remains committed to his policy of lowering interest rates despite high and rising inflation, which puts the country at risk of persistent high inflation. In addition, President Erdogan’s insistence on having executive power over monetary policy could deter the foreign investment upon which Turkey’s economy depends, increasing the risk of encountering hyperinflation. With the next general election not scheduled until June 2023, uncertainty surrounding Turkey’s economy is therefore likely to remain throughout this year.

Turkey’s construction industry growth had already begun to slow down in Q3 2021. This can be attributed to inflated prices for construction materials, which has led to the postponement of major development projects in the country. Overall, the industry grew by just 2.7% YoY in 2021 following a 5.5% YoY reduction in 2020, reflecting weak performance compared to previous forecasts. Further rate cuts by the Central Bank of Turkey this year could undermine confidence in the lira and lead to even higher costs of construction materials, causing the construction industry to grow at a slower rate than predicted. At present, the industry is expected to grow by 2.8% this year, but this forecast could be revised downwards if inflation continues to rise with even higher materials costs.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData