The Taiwanese government is proposing financial aid and special budgets to help industries, including construction-related sectors, cope with the challenges due to the ongoing uncertainty around the US tariffs. Following the US imposition of a proposed 32% US tariffs on Taiwanese imports, on 4 April 2025, the Taiwanese government announced a T$88bn ($2.8bn) support package to help companies and industries affected by new US tariffs. The aid targets sectors such as electronics, IT, steel, machinery, auto parts, building materials, and agriculture. Of the total, T$70bn was allocated for manufacturing (including loan interest reductions, tax breaks, and research and development support), and T$18bn for agriculture (loans and subsidies). The announced aid package includes another T$200bn for trade financing for exporters. The government also plans to negotiate with the US to reduce the tariffs’ impact.

Following this, on 24 April 2025, the government passed a substantial special budget of T$410bn, which would be utilised in addition to the general budgets for the next two years to 2027. This budget is aimed at stabilising employment, prices, and industrial competitiveness amid global trade uncertainties. This budget also aims at the development of the construction sector through enhanced public infrastructure development and maintenance of energy infrastructure. This initiative aims to bolster Taiwan’s economic resilience and national security over the next two years, extending through the end of 2027.

Key components of the special budget:

- Industry support: Approximately T$93bn, increased from the earlier announced T$88bn, is allocated specifically to bolster export industries impacted by the US tariffs. The export-oriented industries affected by tariffs may receive subsidies to expand, renovate, or adapt facilities to new market demands.

- Energy subsidies: A large portion of the budget – T$100bn for a state-owned electric utility company, Taiwan Power (Taipower) – is meant to stabilise the electricity supply and to cover losses from rising fuel costs. This likely includes the upgrading of grid infrastructure, power plant maintenance, and renewable energy infrastructure, all of which would drive demand for construction services, contractors, and material suppliers.

- Security upgrades: T$150bn to enhance Coast Guard operations, development of aerial vehicle infrastructure, and upgrade information and communications systems and facilities.

Earlier, in January 2025, Taiwan’s Legislative Yuan, led by the opposition Kuomintang and Taiwan People’s Party, enacted significant budget cuts totalling T$207.5bn, representing about 6.6% of the proposed T$3.1trn central government budget. Some of the cuts included a reduction of T$200m for the Ministry of Digital Affairs, freezing of T$1bn funding for Taiwan’s fleet of indigenous defence submarines; a reduction of T$100bn in funding for a state-owned electric utility company, Taipower. However, despite the cuts made in the budget, the other allocations remained intact with the original passed budget. Some of the major allocations were public infrastructure expenditure amounting to T$321.8bn, Education, Science and Culture amounting to T$605bn. Moreover, it included an allocation of T$997m to the Taiwan Power Company, an allocation of T$38m for the Taiwan Water Corporation, T$863,189 for Military Education Fund of National Defense Medical Center, T$56m for National Taiwan University Hospital Operations Fund, T$46m for Transportation and Communications Operations Fund. In February 2025, the Executive Yuan determined that the amendment of this year’s total budget should be reconsidered and passed a reconsideration proposal. After the president’s approval, it was to be submitted to the Legislative Yuan for reconsideration. Following this, in March 2025, a ballot was implemented by the Executive Yuan, which voted out the need for there to be another reconsideration of the original budget allocations.

Possible implications of the tariff imposed by the US

The Taiwan economy is expected to face downside risks in 2025 due to the ongoing tariff imposition between Taiwan and the US. Following the imposition of tariffs by US President Donald Trump’s administration on all Taiwanese imports, demand for electronic components, high-tech machinery, and other products is expected to decline in the coming period. According to the US Bureau of Economic Analysis Taiwan was the US’ seventh-largest merchandise trading partner, tenth-largest export market, and eight-largest source of imports in 2024.

Tariff timeline: between Taiwan and the US

- 12 March 2025 – The new tariffs on all steel and aluminium imports took effect, with both metals now taxed at a flat rate of 25%.

- 26 March 2025 – Trump announced a 25% tariff on auto parts imports, affecting various countries, including Taiwan.

- 2 April – The US imposed 32% of tariffs on most Taiwanese goods (except semiconductors), but Taiwan did not announce any reciprocal tariffs against this.

- 6 April 2025 – Also, the Taiwanese president announced negotiations for better tariff rates, by proposing zero tariffs as a negotiation basis with the US in response to new 32% tariffs. It also plans to boost US imports, including agricultural, industrial, petroleum, and natural gas products, and defence equipment and semiconductor investments to ease trade tension.

- 9 April 2025 – The US announced that it will pause for 90 days the tariff effects for over 75 countries, including Taiwan and temporarily lower to 10%.

- 10 April 2025 – In a major move, the government approved a T$88bn support package aimed at strengthening Taiwan’s export supply chain, in response to newly imposed US tariffs. Also, the economy minister Kuo Jyh-huei announced that it could buy a T$6.4trn worth of goods from the US by 2035. This includes increasing imports of liquefied natural gas as part of a potential trade deal.

- 24 April 2025 – The government announced T$410bn to address the tariff impacts.

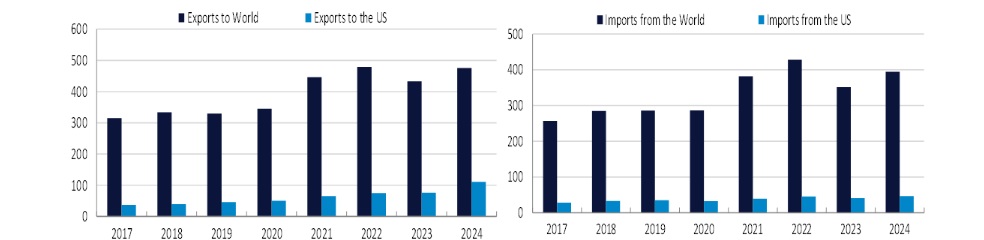

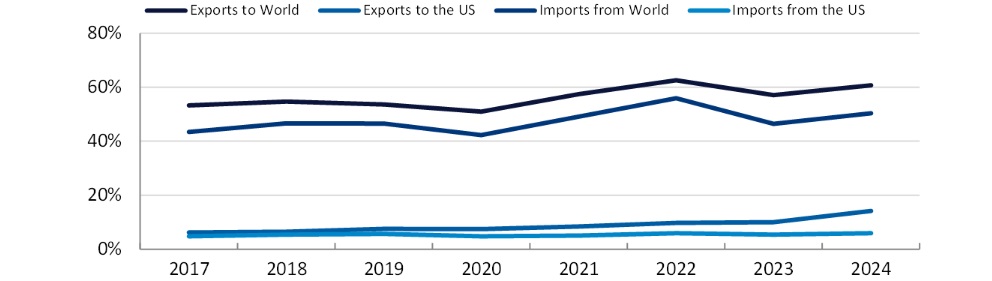

According to the Ministry of Finance, Taiwan exported $111.4bn of goods to the US in 2024, reflecting 23.4% of Taiwan’s total exports. However, Taiwan imported only $46.5bn worth of US goods last year, which is 11.8% of Taiwan’s total imports.

Impact of tariffs on Taiwan’s construction industry:

Tariffs are likely to inflate the cost of imported building materials in Taiwan from the US such as steel, metal, and wood products, thereby resulting in project delays and higher pricing. As a high US tariff scenario may result in a 21% reduction in US exports, a 5% decline in manufacturing production value, and the loss of 125,000 jobs, according to the government, all of which would lower construction demand. However, the exemption of smartphones, computers, and certain electronics from the 145% tariffs on Chinese imports may pose benefits for Taiwanese tech companies. As these companies are key suppliers to US companies such as Apple and Nvidia, they could see stable demand for their components used in these exempted products. Taiwanese tech companies such as TSMC, Foxconn, and Pegatron are likely to experience positive effects from the US decision to exempt smartphones, computers, and other electronics from the 145% tariffs on Chinese imports. These companies are major suppliers of critical components to leading US technology brands such as Apple and Nvidia. With these products excluded from the high tariffs, demand for Taiwanese-made parts is expected to remain steady or even increase, as US companies continue to rely on Taiwan’s high-quality and reliable supply chain. This exemption offers short-term stability and helps shield Taiwan’s tech sector from potential disruptions in global trade.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData