On 27 November 2025, Portugal’s parliament approved the centre-right minority government’s 2026 budget, projecting slightly faster economic growth and a fourth consecutive surplus, despite new tax cuts for companies and low-income earners. The 230-seat parliament passed the bill with 91 votes in favour from the governing alliance, while the Socialist Party’s 58 lawmakers abstained. The budget aims to balance economic growth with fiscal discipline, emphasising support for households and social welfare, while also reducing public debt. Key measures include housing and transport infrastructure development, income tax relief, adjustments to tax brackets to mitigate inflation, and increases in pensions and social benefits, particularly for low-income groups and the elderly. Additionally, the government aims to strengthen the federal system, improving coordination among federal entities to ensure spending contributes to sustainable economic growth.

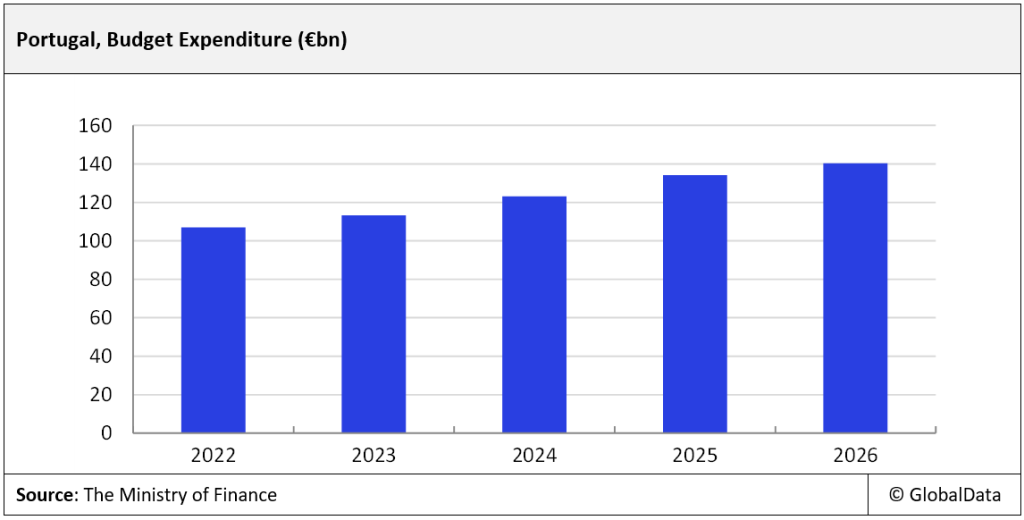

Portugal’s 2026 budget outlines a total expenditure of €140.25bn ($153.14bn), an increase of 4.5% compared to €134.17bn ($146.5bn) expenditure earmarked in the 2025 budget, resulting in a nearly balanced budget. The government projects GDP growth of around 2.3% and expects public debt to reduce to around 87.9% of the GDP in 2026, contributing to its downward trend. A significant portion of the total budget, approximately €28.5bn ($31.12bn), is designated for social protection, which includes pensions and welfare. This budget encompasses tax relief measures designed to protect household incomes from inflation. Under the new budget, the government also prioritises sectors that impact citizens’ well-being, including social development, healthcare, education, and essential public services, while also investing further in infrastructure to promote economic development.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

As part of the 2026 budget, the government allocated €17.2bn ($18.9bn) towards the healthcare sector, up by 2.7% compared to the 2025 budget, €7.5bn ($8.2bn) to the education sector, an increase of 2.2% compared to the previous budget. Furthermore, the government allocated €6.9bn ($7.5bn) towards the infrastructure and housing sector in the latest budget, with an emphasis on building and repairing public housing and improving transport infrastructure, and €2.4bn ($2.6bn) for the environment and energy sector. Furthermore, owing to rising geopolitical tensions, the budget prioritised border and internal security by allocating €3.8bn ($4.2bn) for defence, up by 22.6% compared to the 2025 budget and €3.2bn ($3.5bn) for internal security, up by 3.9% during the same period.

The government is also focusing on the residential sector to address the housing crisis, with an additional €930m ($1bn) allocated for the promotion and rehabilitation of public housing in the 2026 budget. The government plans to deliver 59,000 new public housing units through Recovery and Resilience Plan (RRP) funds and the national budget until 2030. The budget also includes projects for the construction and maintenance of national transport networks, managed by Infraestruturas de Portugal (IP), with a long-term investment of €4bn ($4.4bn) for six main ports by 2035. Airport capacity at Lisbon and Porto will be enhanced, and a new program to encourage direct air routes is expected to launch in 2026. The Infrastructure and Housing Program, comprising 116 projects, has a total budget of €5.8bn ($6.3bn), with €5bn ($5.4bn) from national funding and €879.2m ($960m) from European sources.

To maintain this fiscal balance, the budget combines spending discipline with targeted measures. The government refrains from broad tax increases and instead uses tax reforms (like adjusting income tax brackets and lowering corporate tax rates) to boost economic activity and revenue potential, while protecting households. At the same time, it prioritises essential expenditures such as health, education, infrastructure, and housing within controlled ceilings. These steps are intended to reduce the public debt-to-GDP ratio (projected to fall to about 87%–88%) and ensure long-term fiscal sustainability without harming growth or social support. The government is implementing tax reforms in the 2026 budget to ease the burden on households. Personal income tax brackets increased by 3.5% due to inflation. The tax-free income threshold rises to around €12,880 ($14,064.1), eliminating income tax for earnings up to that amount. For businesses, the corporate income tax rate decreased from 20% to 19%, with a 15% rate for small and medium enterprises on the first €50,000 ($54,596.6) of profits. Additionally, property transfer tax exemptions are introduced for first-time buyers and young people under 35-age for homes up to a certain value. Although the budget primarily focuses on social support and defence in the budget, capital investment in housing and infrastructure remains significant, which will be a key driver of the growth in the construction industry.

The 2026 budget is expected to boost the construction industry, with GlobalData projecting the Portuguese construction industry to grow by 2.3% in real terms in 2026. Additionally, it is anticipated to maintain an average annual growth rate of 1.4% between 2027 and 2030, supported by the government’s investments in transport and energy infrastructure projects, coupled with the government’s Recovery and Resilience Plans (RRP). The government is investing in transport and energy infrastructure projects through its Recovery and Resilience Plans (RRP), which include 83 investments and 32 reforms. In November 2025, Portugal received an eight payment of €1.06bn ($1.16bn) as part of the EU’s €22.2bn ($24.2bn) RRP for upgrading healthcare, housing, social inclusion, and digital infrastructure.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData