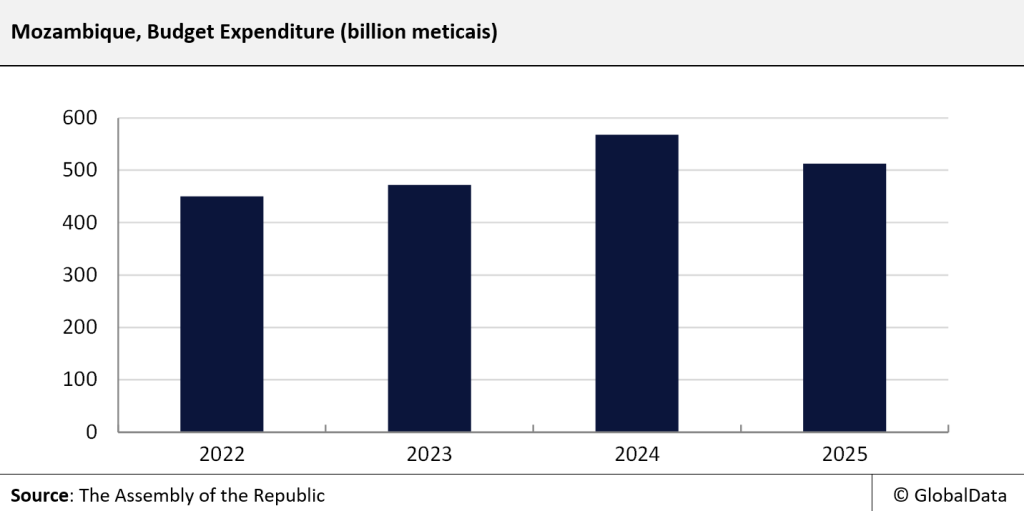

The Council of Ministers of the Mozambique Government has approved the draft law for the Economic and Social Plan and State Budget (PESOE) for 2025 in late April 2025. The budget involves a total spending plan of 512.8bn meticais ($8bn) for 2025, marking a decline of around 9% from 567.9bn meticais ($8.8bn) in the 2024 budget. It also estimates a revenue collection of 385.9bn meticais ($5.9bn), marking an 11.9% growth from 344.8bn meticais ($5.3bn) of revenue collected in 2024. This represents a deficit of 126.8bn meticais ($1.9bn); this represents 8.2% of the nominal GDP. Moreover, the budget also includes a projection for the GDP to grow by 2.9% in 2025 with an average inflation of 7%. The budget is yet to be approved by the Assembly of the Republic.

The budget is expected to boost growth in the construction sector, with the government announcing a 3bn meticais ($45m) from the Sovereign Fund in the 2025 Budget to finance projects included in the National Development Strategy (ENDE). This covers education, healthcare, water infrastructure, agriculture and transport infrastructure projects.

- 22% of the total fund will be allocated for the expansion and rehabilitation of the water infrastructure.

- 14% of the total fund will be allocated for improving health facilities, including vaccination for children under the age of one.

- 10.4% of the total fund will be allocated for the construction of 12 secondary schools and 7.6% for the construction of 214 primary school classrooms.

- 9.6% of the total fund will be allocated for equipping five technical and vocational education institutes.

The Sovereign fund also outlines the government’s target of building ten new dams, along with completing the construction of two feed mills in Niassa and Nampula and the installation works of two new cold storage warehouses in the industrial parks of Topuito and Beluluane. Furthermore, for bolstering the field of entrepreneurship, startup kits for 150 new businesses will be distributed mainly in the field of agricultural, mining, service and industrial sectors.

The PESOE also includes the implementation of natural gas projects in the Rovuma Basin that will be undertaken by the French integrated energy and petroleum company TotalEnergies and Italian energy company Eni. This implementation is part of the government’s projection of attracting $5.07bn of foreign investments in 2025, marking a growth of around 43% compared to that of 2024. However, this is still below 2021’s level of $5.10bn.

Notably, the budget got delayed amid a change in government and the post-election disruption. In December 2024, the Constitutional Council (CC) declared Daniel Chapo the winner of Mozambique’s presidential election, who secured 65.17% of the vote and succeeded the outgoing President Filipe Nyusi, who received only 24% of the vote. This announcement sparked unrest across the country, mainly among the supporters of the opposing candidate. Demonstrators took to the streets, erected barricades, looted businesses, and clashed with security forces. The police responded with gunfire to disperse the crowds.

In light of the political instability, in late December 2024, the Mozambican Government stated its decision to extend the 2024 State Budget on a provisional basis, with the 2025 budget expected to be approved during the first half of the year. The 9% reduction in the expenditure of the budget is attributed to the government’s commitment to fiscal restraint following the post-election unrest and uncertainty in late 2024 that adversely dented the overall growth, economic activity and revenue generation. The expenditure plans outlined in the budget prioritised wages, which will constitute 14.6% of the GDP, including limited social transfers and security provisions. Also, the debt interest payments are projected to constitute 4.2% of GDP, which might pose challenges for public investments, as it might crowd out the spending on infrastructure projects. According to the latest projections released by the International Monetary Fund (IMF) in April 2025, the public debt in Mozambique is expected to rise to 101.1% of GDP in 2025 from 96.6% in 2024. The increasing debt-to-GDP ratio is attributed to investments in gas and hydroelectric projects. According to the IMF, the ongoing borrowing for the development of the liquefied natural gas (LNG) projects is projected to be covered by the natural gas revenues, but the country’s ability to cover all other debt payments through revenue generation remains uncertain in the medium to long term.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFurthermore, Fitch, the global credit ratings agency, downgraded the country’s Long-Term Foreign-Currency Issuer Default Rating (IDR) in February 2025 to ‘CCC’ from ‘CCC+’, owing to weak public finances and rising debt. At the time of government financing needs, the unresolved political and social issues have hit the country’s financial position in December 2024. The interest payment which Mozambique is incurring on its Eurobonds of $900m grew from 5% to 9% per year in 2023, increasing the total interest to be paid in a year from $45m to $81m and from 2028, the country is required to pay $250m till 2031. The increasing debt payments, coupled with political unrest, are expected to slow down the implementation of the ongoing and scheduled construction projects, thereby forming a downside risk for the construction industry.