The Italian Parliament approved the government’s 2026 budget on 30 December 2025. The budget, which incorporates deficit-cutting measures, was approved with 216 votes in favour, 126 against, and three abstentions. The budget law includes new spending and tax measures amounting to approximately €22bn ($24bn), and focuses on low-income earners, while reducing taxes for families, employees, and the middle class; it also complements these priorities with targeted measures to support businesses. Overall, the 2026 budget law strengthens purchasing power, enhances healthcare, and boosts competitiveness in the manufacturing sector. However, the budget doesn’t include any specific package or details on infrastructure spending.

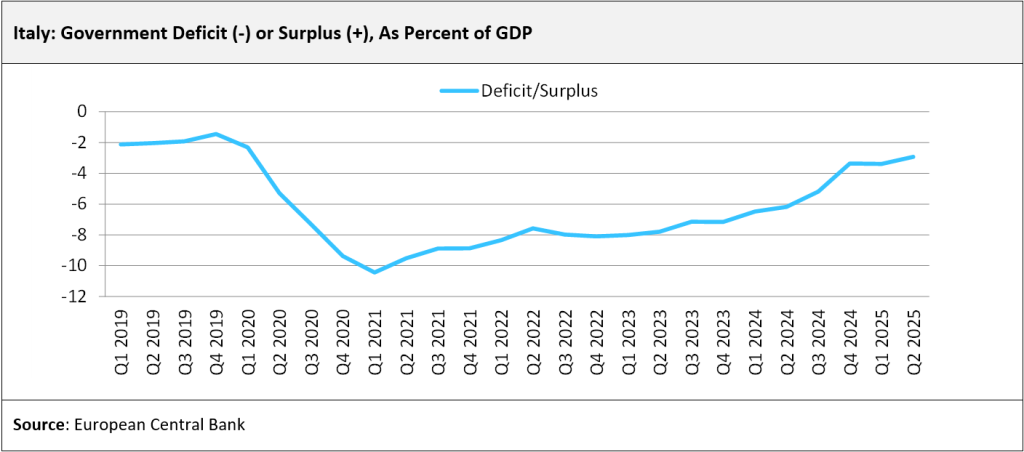

Italian Prime Minister Giorgia Meloni’s fourth budget aims to lower the fiscal deficit in 2026 to 2.8% of the GDP – down from the previously targeted rate of 3% – in line with the European Union’s demands. This will allow the country to exit an infringement procedure for excessive deficit initiated by the EU in 2024. Italy’s public debt, which is the second highest in the euro zone after Greece, is however, projected to climb to 137.4% of GDP in 2026 – up from a forecasted rate of 136.2% in 2025; on a positive note, this rate is expected to start easing slightly from 2027. As per the latest budget law, economic growth in Italy is projected to rise from an estimated rate of 0.5% 2025 to 0.7% in 2026.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Some of the tax measures and income support measures announced in the 2026 Budget include:

- Reduction of the rate applied to the second tax bracket from 35% to 33%, for middle-class households with an annual income between €28,000-€50,000 ($30,508.4- $54,479.2).

- Confirmation of the renovation bonus rules, with 50% renovation bonus for first homes and 36% for second homes and beyond, and the furniture bonus of up to €5,000 ($5,447.9) for 2026. This benefit allows people to deduct from their personal income tax a portion of the expenses incurred for maintenance, restoration, and conservative recovery work.

- Confirmation of increase in the threshold to €35,000 ($38,135.5), for income from employment or a pension that qualifies for the 15% flat tax on self-employed income.

Families, work and social policies:

- Elimination of the three-month increase in the retirement age, starting in 2027, for workers engaged in strenuous and arduous activities. For the remaining categories of workers, however, the increase will be of only one month in 2027 and two months in 2028.

- Establishment of a fund for housing support for separated and divorced parents, with a budget of €20m ($21.8m) starting in 2026.

- A monthly increase of €20m ($21.8m) is expected in pensions for those in difficult circumstances.

Healthcare:

- In addition to the refinancing planned in 2025 by the budget law, amounting to over €5bn ($5.4bn) for 2026, €5.7bn ($6.2bn) for 2027, and nearly €7bn ($7.6bn) for 2028, €2.4bn ($2.6bn) will be added for 2026 and €2.7bn ($2.9bn) starting in 2027. Part of this funding will be allocated to new hires and improved treatment for healthcare workers. Measures have also been introduced to reduce waiting lists and ensure compliance with healthcare service delivery deadlines.

Building renovation and energy efficiency upgrades:

- The tax regime, which was established for 2025 by the 2025 Budget Law, for building renovation, energy saving, and earthquake-proofing projects is extended through 2026.

Excise duties on gasoline and diesel fuel used as motor fuel:

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataReports

Italy Construction Market Size, Trend Analysis by Sector, Competitive Landscape and Forecast to 2029 (Q4 2025)

- The excise duty rates on gasoline and diesel fuel used as motor fuel are being aligned, thereby bringing both rates to €672.90 ($733.2) per thousand litres. Fuels used for agricultural purposes, for machinery or stationary engines used in industrial plants, or for cargo handling equipment in ports are exempt from the excise duty increase.

Prime Minister Meloni reported that the budget law will enable the country to come out of the excessive deficit procedure in 2026, without giving up on pursuing the government’s goals that were set while taking office. One of these goals is to support companies and producers, and to create jobs and wealth in Italy. As part of the budget law, the government has reintroduced super- and hyper-depreciation, which are two instruments that are effective in supporting investments in innovation and the ecological transition. The government reported that, for the period of 2026 to 2028, it will provide stability to the tax credit for investments made in the Single Special Economic Zone (SEZ), with a total allocation of more than €4bn ($4.4bn). The government will also provide fresh funding for the ‘Nuova Sabatini’ scheme and has also confirmed the 120% ‘super deduction’ of labour costs to incentivise new hires; this will provide a tax incentive allowing businesses to deduct 120% of the labour costs for qualifying new permanent hires.