The Government of Israel approved the State Budget and an accompanying economic plan for 2026, on 5 December 2025. The budget will amount to approximately NIS662bn ($175.7bn), with the deficit ceiling set at 3.9% of the GDP – 0.7% higher than the deficit ceiling planned by the Ministry of Finance in early November 2025. The 2026 Budget will focus on returning the Israeli economy to a path of growth, following three years of war budgets in which the Israeli economy supported the security campaign. The budget also includes measures to freeze income tax brackets, keep VAT at 18%, tax banks’ excess profits, ease dairy import tariffs, introduce a tax on e-cigarettes, and expand VAT exemptions. As part of the latest budget, the government raised the VAT exemption ceiling for imports from NIS282.5 ($75) to NIS565.1 ($150); expanded the scope of the 20% and 31% tax brackets for middle-income earners; approved reforms in the dairy market – such as loosening of tariffs on dairy imports – to reduce prices.

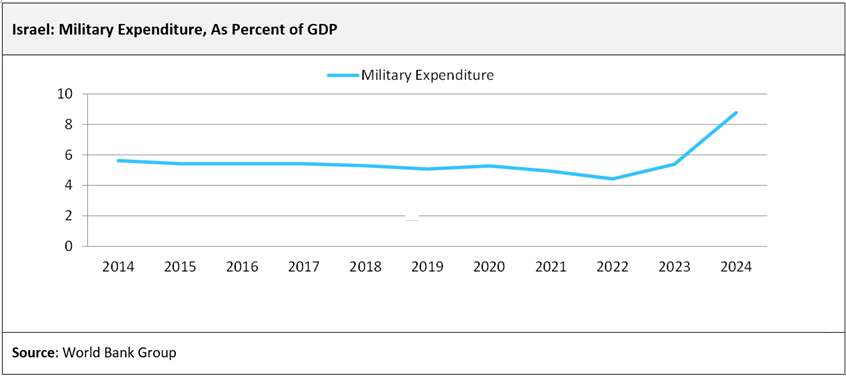

The latest budget includes an allocation of NIS112bn ($29.7bn) for the defence sector in 2026, which is down from an allocation of NIS135.7bn ($36bn) in 2025 and NIS117.5bn ($31.2bn) in 2024. This reduction in the defence budget is due to an expected drop in the recruitment of reserve soldiers in 2026, following the Gaza ceasefire that took effect on 10 October 2025. Despite the decrease compared to the wartime budgets, the 2026 defence budget is still NIS47bn ($12.5bn) higher than the 2023 defence budget, which covered most of the period before the Gaza war erupted in October that year; this increase is to ensure the security of the citizens of Israel and the Israel Defence Forces’ (IDF’s) ability to cope with the threats posed. In addition to the 2026 defence budget, the government has also agreed on a separate three-year budget package of approximately NIS725m ($192.4m) to reinforce security infrastructure in the occupied West Bank, including travel protection measures, new road construction, military facilities, and projects along the eastern border with Jordan.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The latest budget includes measures to support the housing sector, through development subsidies, rental assistance, and removal of barriers to urban renewals. The Treasury and Housing Ministry agreed to allocate approximately NIS700m ($185.8m) to fast-track housing tenders, accelerate construction processes, and subsidise development in peripheral regions. An additional NIS250m ($66.4m) has been allocated for the renovation, maintenance, and rehabilitation of public-housing units. Furthermore, a proposal to sharply reduce the share of long-term rental units required in large development zones was eased following resistance from the Planning Administration; it will now review feasibility before any reductions are considered. This move is a part of the Ministry of Construction and Housing’s efforts to regulate the rental market and increase the supply of rental units. The current requirement mandates 30% of apartments in large, fast-tracked housing zones to be set aside for long-term rentals, some at reduced prices.

The Ministry of Education reached a budgetary agreement with the Ministry of Finance, setting its 2026 budget at approximately NIS94bn ($25bn); this marks an increase of more than NIS4bn ($1.1bn) compared to the 2025 budget. The funding will be used for special education, emotional and therapeutic services, postwar support, STEM programs and infrastructure upgrades. The higher education budget will not be cut, and within its framework, an advanced national computing centre will be established over the next five years, in the field of AI, with a budget of NIS1.3bn ($345.1m). The budget, however, does not address the issues of teacher shortage, overcrowding in classrooms, and the severe shortage of classrooms in schools. According to a report published by the Organization for Economic Co-operation and Development (OECD) in September 2025, Israel has the second-most crowded classrooms among OECD countries, after Chile.

The ministries of transportation and finance have also finalised the 2026 budget, which includes measures to reduce travel costs, ease licensing, develop railways, upgrade infrastructure, improve public transportation services, develop smart transportation, and promote competition in the automotive industry. The budget includes NIS350m ($92.9m) to implement the National Road Safety Plan in 2026, which aims to halve road fatalities and serious injuries by 2030, through increased enforcement, infrastructure changes, public awareness campaigns, and improved data systems. The budget also includes funding for paving and upgrading national roads, promoting new railway tracks, upgrading national and metropolitan roads, upgrading roads in the Reconstruction Area and the north of the country, electrification of public transportation terminals, and continued deployment of traffic management technologies.

The budget proposal will now move to the Knesset (Israeli Parliament) for its first vote, where it faces stiff resistance amid deepening divisions within the governing coalition. As per Israeli law, failure to pass the budget by March 2026 would automatically trigger a national election, thereby raising the stakes for Prime Minister Benjamin Netanyahu’s government.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataReports

Israel Construction Market Size, Trend Analysis by Sector, Competitive Landscape and Forecast to 2029 (H2 2025)

Altogether, the 2026 budget is expected to provide a boost to the construction industry, particularly to the housing and transport infrastructure sectors. Additionally, a fall in interest rates is expected to boost investor and consumer confidence, thereby attracting public and private sector investments in the industry. In early January 2026, the Central Bank of Israel lowered interest rates for a second straight time, amid projections that the economy would recover faster than expected from the repercussions of the two-year war with the Hamas terror group. The central bank cut borrowing costs by 25 basis points (bps) from 4.25% to 4%. Previously, in November 2025, the central bank had reduced the benchmark lending rate for the first time in almost two years from 4.5% to 4.25%, following a ceasefire agreement with Hamas. Since the ceasefire agreement, inflation has slowed, the Israeli Shekel has strengthened, and the employment rate has increased. The annual inflation rate in Israel eased to a four-year low of 2.4% in November 2025 – from 2.5% in October 2025; in August 2025, the inflation rate moved within the government’s annual target range of 1%-3% for the first time since June 2024. The improving economic conditions and employment situation, and the recent budgetary allocations are expected to support the Israeli construction industry in achieving an annual growth of 7.8% in 2026, according to GlobalData’s projections. Reflecting the improvement following the ceasefire, the construction output value (in real terms) is expected to rise from $62.4bn in 2023 to $66.5bn in 2026 – up from $61.7bn in 2025 and $54.6bn in 2024.