Given Greenland’s strategically positioned location – between North America and Europe – the territory has long been recognised by US policymakers as critical to national security, hosting the US military’s Thule Air Base and offering proximity to Arctic shipping lanes opening as ice retreats due to climate change. In recent weeks, Donald Trump has revived talk of the United States acquiring the Danish autonomous territory, arguing that doing so would safeguard US security interests and counter Russian and Chinese influence in the Arctic.

However, Trump’s interest in Greenland may reflect more than geopolitics. It could also align with a drive to secure access to critical minerals needed for next-generation technology infrastructure, including large-scale AI data centres and power grids. Greenland is known to have vast endowments of critical minerals – including rare earth elements (REEs) that are vital for advanced electronics, renewable energy, EVs, and the semiconductor and AI supply chains. As a result, this places Greenland at the centre of strategic resource competition. According to the EU Commission, estimates show Greenland holds significant quantities of 25 of the EU’s 34 critical raw materials, underscoring its resource potential. These minerals, such as copper, nickel, and rare earths, are closely linked to the buildout of high-tech infrastructure and data centres.

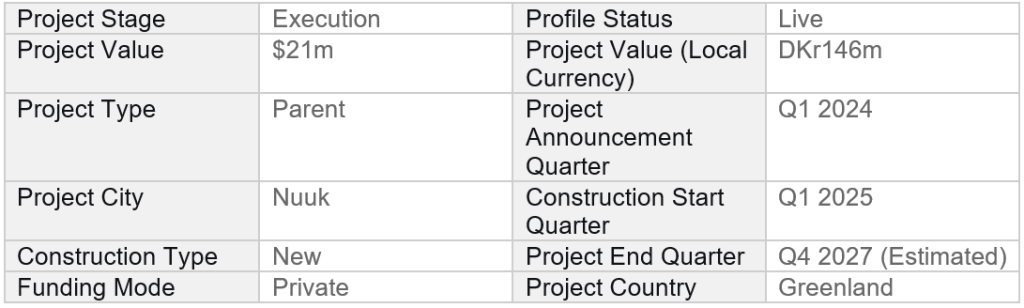

Furthermore, given that data centre electricity consumption globally is set to increase by 50% by 2027 from 2023, according to Goldman Sachs, Greenland could also be an ideal location to build and strategically position data centres. From the perspective of data infrastructure, Greenland’s Arctic climate offers inherent advantages. For example, the naturally cold ambient climate could dramatically cut cooling requirements, which currently account for nearly 40% of a typical data centre’s energy consumption. In addition, Greenland’s renewable energy capacity is currently growing, with 70% of Greenland’s energy generated from hydropower. As a result, access to renewable hydropower and wind resources could present an opportunity for low-carbon electricity, with future data centres being powered by surplus green energy, another attractive factor for AI and hyperscale computing hubs. Currently, Greenland has only one operational data centre, situated in Nuuk, while GlobalData is currently tracking one additional data centre construction project in the country. The DKr146m ($21m) Nuuk data centre project is a Tier III colocation facility currently under construction in Nuuk, Greenland and operated by Tusass A/S. This construction project stands out for its commitment to sustainability and is designed to run on 100% renewable energy. Additionally, once operational, the Nuuk data centre will implement a free cooling system, leveraging Greenland’s cold climate to reduce energy consumption for cooling infrastructure, which is considered critical for data centre efficiency.

Tusass – Nuuk data centre – Sermersooq – project overview

Crucially, this debate is unfolding as opposition to data centres across the US intensifies. Critics argue that soaring power and water demand, caused by the data centre buildout, could outstrip local supply, pushing up electricity and water prices. Others claim data centres produce excessive noise and harm wildlife. According to the monthly electricity report released by the Energy Information Administration, residential electricity rates increased 5.2% year-on-year in October 2025, while electricity costs for areas situated closer to data centre hubs have increased by considerably more. In terms of water consumption, data centres are expected to need 170% more water by 2030, according to a report from WestWater Research. In addition, there are also concerns regarding the US power grid capacity. According to a July report from the US Department of Energy, 100GW of new peak capacity will be needed in the US by 2030, of which 50GW can be attributed to the Data Center buildout. The Department of Energy estimates that data centres can be built in 18 months, yet adding the generation needed to serve them will take more than three times as long. Many of these problems often arise due to intense data centre agglomeration, while hubs in more remote locations are less impactful on public resources. Therefore, interest in building data centre campuses on a remote island with abundant natural resources and only 57,000 inhabitants is appealing. Additionally, existing subsea cables connecting Greenland to North America – and plans by local telecoms provider Tusass A/S to expand links to Canada and Iceland – further bolster its feasibility as a transatlantic data and network hub.

However, if such plans did materialise, the implications for construction would be significant. Developing scalable, climate-resilient data campuses in Greenland would require major site preparation as well as expanded ports and airfields, new power generation, and grid extensions. Alongside social factors, including increased housing and utilities and logistics facilities – essentially pioneering a new industrial frontier above the Arctic Circle where current infrastructure is sparse. Furthermore, this would also drive demand for specialised Arctic engineering firms, modular construction techniques adapted to permafrost and extreme cold, and international consortia to manage the enormous capital costs, which could approach hundreds of billions of dollars over decades.

Clearly, major hurdles remain before Greenland is considered a future focal point of global infrastructure competition and the next frontier for global data center growth. Nonetheless, the convergence of Arctic geopolitics, AI infrastructure requirements, and the construction sector’s ability to build entirely new industrial ecosystems suggests that any move by Donald Trump to acquire the territory would not only carry profound consequences for Nato but could also reshape construction markets globally and accelerate Arctic infrastructure development.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData