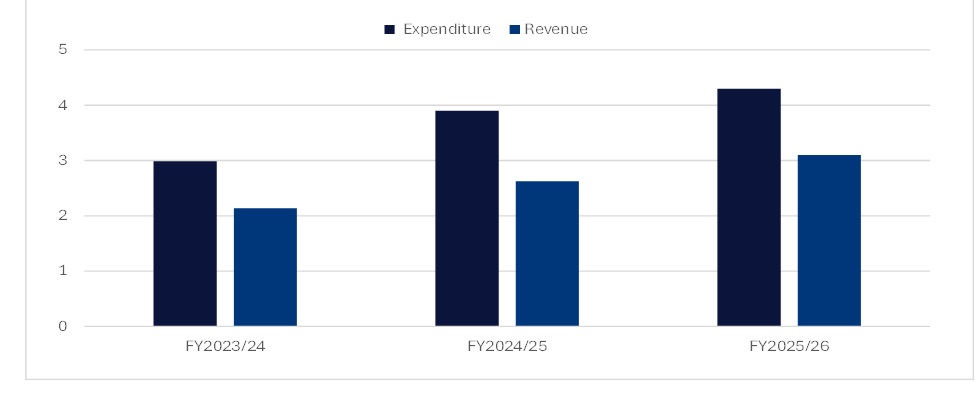

In March 2025, the Egyptian government announced the fiscal year 2025-26 budget (FY25-26), which will be in effect from July 2025 to June 2026. Total government expenditure for FY25-26 is estimated at E£4.6trn ($91.3bn), representing an 18% increase compared to the expenditure allocated for FY24-25. Revenue is projected at E£3.1trn, a 19% increase compared to the 2024-25 budget. The government has also set a primary surplus goal of E£795bn, which represents 4% of gross domestic product (GDP). This is an improvement over the FY24-25 target of 3.5%. This goal closely aligns with International Monetary Fund benchmarks and signals a commitment towards fiscal sustainability. Additionally, public debt is projected to decrease significantly, dropping to 82.9% of GDP in FY25-26 from an estimated 92% in FY24-25, reflecting a dedicated approach towards effectively managing debt. Overall, the FY25-26 budget prioritises transformative investments in the electricity and renewable energy sectors, urban development, and essential water and sanitation services to enhance the nation’s infrastructure and improve the quality of life for its citizens.

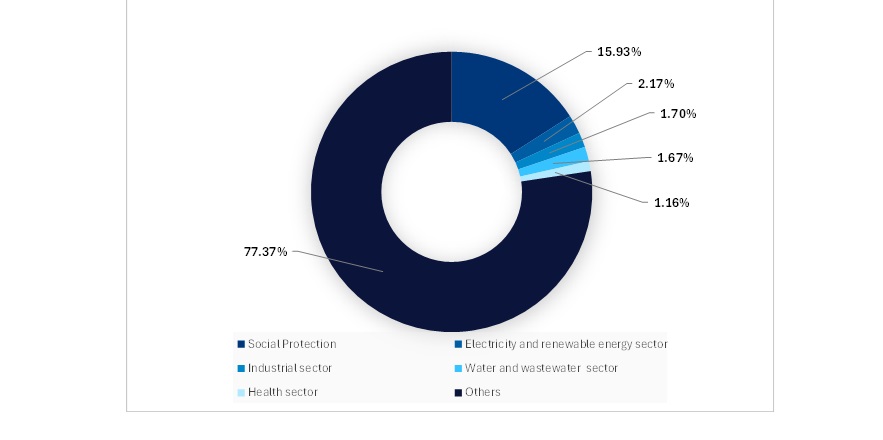

In the FY25-26 budget, the government announced several allocations for different sectors, with areas focused on energy, social infrastructure, water infrastructure, health, and other basic infrastructure developments, some of which include –

– E£732.6bn for social protection.

– E£100bn for the electricity and renewable energy sector.

– E£78bn to support the industrial and export sectors.

– E£77bn for the water and wastewater sector.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData– E£75bn to support the petroleum sector.

– E£8.3bn for the tourism sector.

– E£5.bn for the railways sector.

– E£5bn to enhance high-priority industries by expanding production capacity in machinery and equipment.

– E£3.5bn to support natural gas connections to homes.

– E£2.5bn in the new budget to support passenger transport in Cairo and Alexandria.

Infrastructure, energy, housing, and urban development are crucial components of the government’s national plan for FY25-26, providing substantial support for the construction sector. In line with this, the government intends to build 310,000 housing units during FY25-26. This includes 285,000 units designated for social housing, 11,500 for middle-income groups, and 13,500 under the ‘Housing for All Egyptians’ programme. Additionally, more than 20 new urban communities are being developed to accommodate population growth and alleviate pressure on major cities.

In the infrastructure and utilities sector, an allocation of E£77bn has been made for water and sanitation in FY25-26. This includes E£27.8bn designated for drinking water and E£49.2bn for sanitation. The government also plans to complete the following projects: 56 water stations with a total capacity of one million cubic metres (mcm) per day, 135 sanitation projects, 33 treatment plants with a capacity of 802,000cm per day, and 17 desalination plants with a capacity of 455,000cm per day. Notable projects such as the Bahr Bagar wastewater treatment plant, which has a capacity of 5mcm per day, and the Kitchener Drain rehabilitation are also scheduled for completion in FY25-26.

The government aims to generate 235 billion kilowatt hours of electricity by the end of FY25-26, which is an increase from 223 billion kilowatt hours in 2023-24. Additionally, it plans to reduce energy losses to 13%, down from 19.4% in 2023-24, and increase the share of renewable energy in the mix to 16%, up from 11.5% in 2023-24. To achieve these goals, the government intends to complete several major energy construction projects in FY25-26. These projects include the Mallawi and Matariya transformer stations and electrical infrastructure for the Monorail and LRT systems. Furthermore, a 20MW solar plant in Hurghada and land development for six additional renewable energy projects are being planned. Collectively, these initiatives will promote a robust and active role for the construction industry in both the short- and long-term national development objectives. The latest budget is expected to boost the construction sector, with leading data and analytics company GlobalData anticipating a 6.5% growth in the Egyptian construction industry in real terms by the end of the forecast period. Furthermore, the industry is projected to maintain an average annual growth rate of 8% between 2026 and 2029. Indeed, this growth will be supported by investments in commercial, renewable energy, and transport infrastructure projects, along with the government’s goal of developing 10GW of renewable energy projects by 2028 under the Nexus of Water, Food, and Energy Program. In November 2024, the government signed an agreement with Dubai-based energy investor, Alcazar Energy Partners, to develop 2GW of wind power projects in Egypt, aligning with the country’s energy targets. Additionally, in December 2024, Emirati investment company, Kazar, announced plans to invest $2.5bn to construct 2GW of solar energy and 1.1GW of wind energy projects in the Zafarana region, with construction expected to start in 2026. Support for growth during this period will also stem from the government’s plans to develop 32 hydrogen plants, with a combined investment of E£5.4trn by 2030. In December 2024, SCZone announced that it had finalised 12 agreements to produce a total of 18 million tons of green hydrogen annually by 2030. Another project is also in the planning stages, with an investment of $7.5bn and a projected output of 1.3 million tons per year. Additionally, the government aims to construct 672,000 housing units by 2030, with an investment of $13.4bn, addressing housing shortages resulting from rapid population growth and aiming to eliminate slums in the country by 2030.