In the first quarter (Q1) of 2025, Israel’s economy experienced a moderate recovery, as a temporary ceasefire in Gaza enabled businesses to rebound before hostilities resumed in mid-March. A ceasefire had come into effect on 19 January 2025 and ended in mid-March 2025. Separately, a fragile ceasefire with Hezbollah in Lebanon has held since late November 2024, although Lebanese authorities have claimed about 3,000 violations of the ceasefire, which have resulted in more than 200 deaths. According to the preliminary estimates of Israel’s Central Bureau of Statistics, the country’s economy grew by 3.4%, on an annualised basis, in the first quarter of 2025; this was preceded by growths of 1.9% in Q4 and 5.7% in Q3 2024. The moderate growth in Q1 2025 was driven by an annualised 8.7% growth in fixed-asset investment and a 6.2% rise in exports, excluding diamonds and startups. Despite the growth momentum, private consumption fell by 5% on an annualised basis in Q1 2025, following a growth of 4.1% in Q4 2024. A decline in private consumption is generally seen as an indicator of declining consumer confidence and increasing concerns about the economic future.

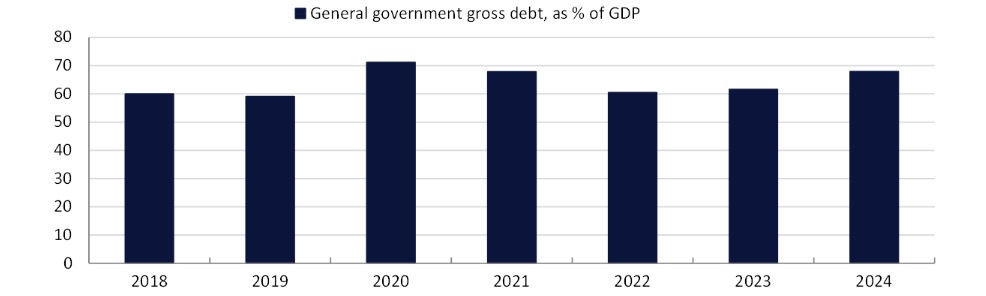

The economic risks in Israel have been rising in recent weeks, due to the end of the ceasefire in Gaza and the resumption of fighting. Israel resumed military operations in Gaza in mid-March 2025, following the end of a two-month ceasefire; this has led to a sharp escalation in violence and civilian casualties. According to Gaza’s Ministry of Health, at least 145 people were killed and over 450 people were injured in the first 24 hours alone. The resurgence of the war is likely to impact economic growth due to the mobilisation of reservists (a member of the military reserve forces), as businesses will have to find replacements for the employees who are called back to reserves. Additionally, the expenses related to mobilising reserve soldiers increase, thereby negatively impacting the economy; according to a study by Israel’s Ministry of Finance conducted in 2024, the economic cost of a reserve soldier is approximately NIS48,000 ($12,741) per month. Moreover, financing the war requires raising the debt in enormous amounts; as a result, the debt raised in 2024 exceeded that raised during the Coronavirus (Covid-19) crisis in 2020. According to government data, the country raised NIS278bn in debt in 2024, compared to NIS265bn in 2020.

Another key factor that is likely to weigh on Israel’s economic growth is the approval of the country’s largest state budget ever. Although the approval of a budget represents a political achievement for Prime Minister Benjamin Netanyahu’s government, it also presents a likely economic risk for the country, with the Bank of Israel and the Ministry of Finance repeatedly stating that the current government’s priorities do not align with the economic challenges facing the country. Subsequently, there is a significant gap between the recommendations of professional bodies for the 2025 budget and the budget that was approved.

In late March 2025, Israel’s legislature – the Knesset – approved the 2025 state budget. The budget includes an expenditure of nearly NIS756bn, of which NIS136bn is intended to service the national debt. The government had allocated a significant portion of its overall budget towards the Ministry of Defense, amid its ongoing war against Hamas and Lebanon. The Ministry of Defense accounts for approximately NIS110bn of the remaining NIS620bn in spending. The budget, however, lacks policies aimed at promoting economic growth, contains no significant cut to the unnecessary coalition funds, and excludes funds promised under the ‘Tkuma Law’ for the rehabilitation of the communities along the Gaza border and in the north. In another setback, despite the minister of finance’s December 2024 promise that the deficit would not exceed 4% of gross domestic product (GDP), the planned deficit in the approved 2025 budget already stands at 4.9%. This follows two years in which Israel did not meet its planned deficit target due to the war; in comparison, the deficit reached 4.1% of GDP in 2023 and 6.8% in 2024.

The budget also places most of the burden on Israel’s working population, with increases in National Insurance contributions, freezing of income tax brackets, reduction of paid convalescence days, and an increase in VAT; all these factors are likely to further impact economic growth. Although the budget includes across-the-board cuts in the education, health, and welfare sectors, the government had allocated the second- and third-largest budgetary allocations towards the education and healthcare sectors. The Ministry of Education received NIS92bn as part of the 2025 budget while the Ministry of Health received NIS59bn.

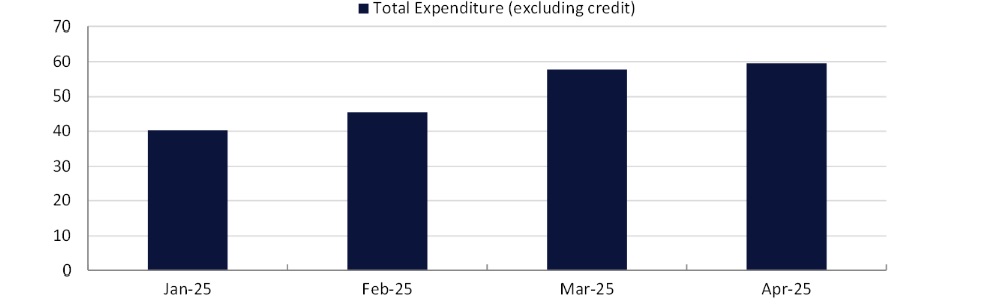

The Israeli Ministry of Finance reported in mid-May 2025 that the country’s budget deficit for the 12 months to April 2025 narrowed to 5.1% of GDP; this figure is, however, above the government’s deficit target, which is capped at 4.9% of GDP. The country registered a budget deficit of NIS7.2bn in the first four months of 2025, compared to NIS38.1bn during the same period in 2024. This improvement is due to a 24.5% year-on-year (YoY) increase in tax revenues during January-April 2025, which was bolstered by stronger economic activity. The government’s spending during the same period has, however, increased by 3.9% YoY, to NIS202.8bn. The increase is due to a rise in defence expenditure amid its ongoing war against Gaza and Lebanon, and additional allocations under the newly enacted annual budget.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe Israeli Ministry of Finance has also reported that the government has implemented 32.8% of its original budget expenditure (excluding credit) as of April 2025. In comparison, the Ministry of Defense has implemented 39.2% of its total budget while the Civilian Ministries implemented 30.2% of its total budget, as of the same period. The implementation rate of some of the Civilian Ministries as of April 2025 were 33.9% by the Economic Ministries, 31.6% by the Social Ministries, and 26.6% by the Administrative Ministries.

In April 2025, the International Monetary Fund (IMF) revised down its economic growth projections for Israel for 2025 and 2026, despite expectations that these two years would mark a period of recovery following a year of war and sluggish growth in 2024. The IMF now expects the Israeli economy to expand by 3.2% in 2025 and 3.6% in 2026 – down from its previous forecast of 3.5% growth in 2025 and 4% in 2026. The IMF also expects inflation in Israel to be slightly higher this year (2.7%) than the Bank of Israel’s estimate (2.6%), but slightly lower in 2026 (2%) compared to the central bank’s projection (2.2%).