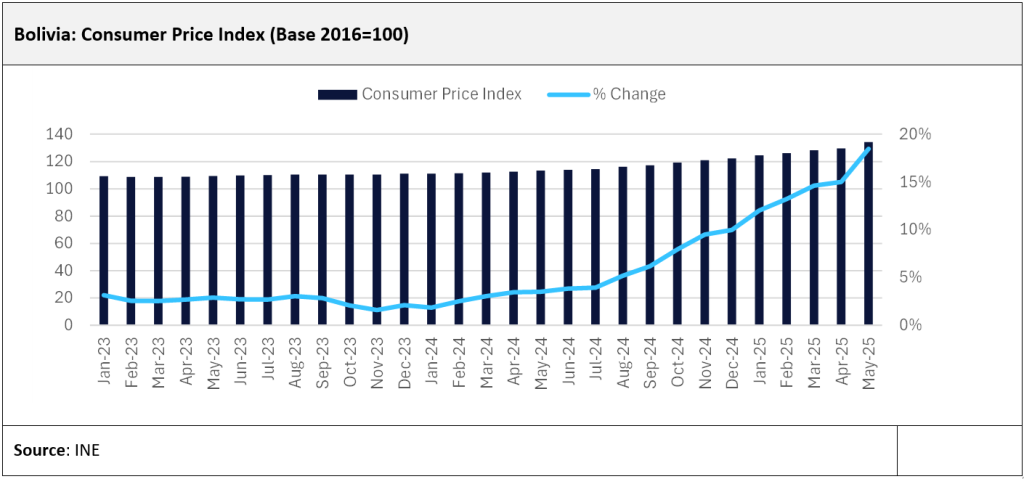

Bolivia is currently facing an economic crisis that has led to widespread social unrest throughout the nation, with the country risking defaulting on its loan payments unless it secures new foreign financing. With inflation reaching a staggering 18.5% year-on-year (YoY) in May 2025 and foreign exchange reserves diminishing, Bolivia’s economy has now found itself at a crossroads during H1 2025.

The International Monetary Fund (IMF) forecasts a total of 15.8% inflation for 2025, highlighting limited fiscal capacity and difficulties arising from fuel shortages, protests, and floods that are affecting food production. Several elements are influencing this continuous rise in prices in Bolivia, but the most significant is the decrease in natural gas production, which has adversely affected the nation’s capacity to generate foreign currency (US dollars). Consequently, this has resulted in higher import expenses and an overall increase in prices, compounded by the recent fuel shortage.

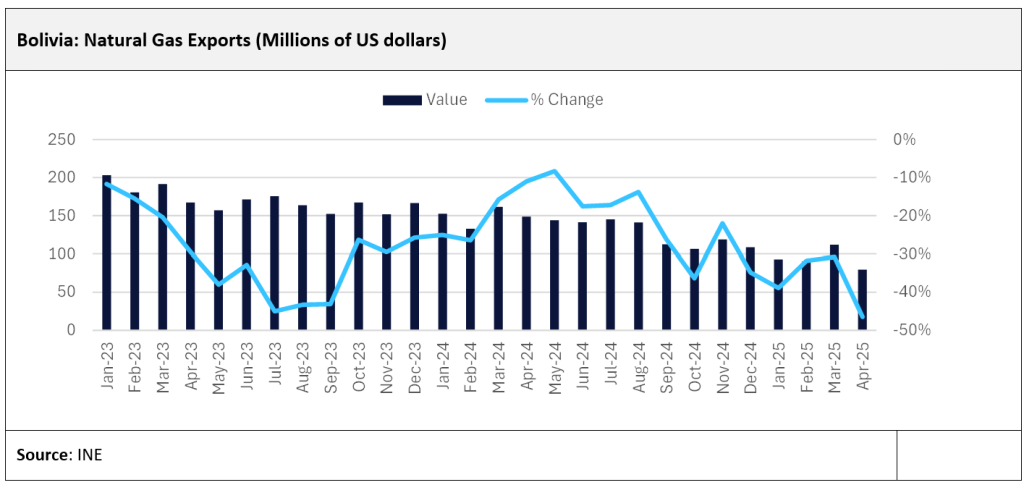

Bolivia is a significant natural gas producer and exporter, but the natural gas production has seen declines in recent years due to underinvestment and natural decline of existing fields. According to Yacimientos Petrolíferos Fiscales Bolivianos (YPFB), a state-owned oil industry company, Bolivia’s natural gas production has declined from 56.6 million cubic metres per day in 2016, to 31.9 million cubic metres per day in 2023. Additionally, according to the Bolivian Institute of Statistics (INE), the average daily natural gas production recorded in Q1 2025 was 28.7 million cubic metres per day, a decrease of 16% compared to the first quarter of 2024 and below YPFB’s expectation of 29.3 million cubic metres per day.

The combination of declining natural gas production and falling foreign exchange (FX) reserves, along with depreciation of the parallel exchange rate, has led the IMF to revise its forecast for real GDP from 1.3% in 2024 to 1.1% in 2025 and then down further to 0.9% in 2026. Amid the shortage of dollars and the ongoing fuel crisis, YPFB also announced its intention to use cryptocurrency to pay for energy imports in March 2025. On 10 March 2025, President Luis Arce issued Decree 5348, authorising YPFB to purchase foreign currency through the national financial system and utilise “virtual assets” for fuel imports, marking a significant policy shift for the country, which involves converting Bolivianos to cryptocurrency equivalents at the daily dollar exchange rate to pay for fuel imports.

As reported by the World Bank, Bolivia’s debt accounts for approximately 37% of its gross national income. In June 2025, the President announced that the nation requires $2.6bn by December 2025 to cover fuel imports and external debt obligations. The situation has been exacerbated by rising political instability, with the country undergoing a power struggle within the ruling party – Movimiento al Socialismo- Instrumento Político por la Soberanía de los Pueblos (MAS-IPSP) – between President Luis Arce and former President Evo Morales. Despite stepping down as president over accusations of electoral fraud in 2019, Morales maintains a strong base of support, particularly among indigenous populations. Meanwhile, the initial achievements of Arce’s administration were ultimately overshadowed by a socioeconomic crisis in Bolivia that began in 2023, triggered by a lack of foreign currency reserves, as well as a decline in natural gas production and exports, and soaring inflation – further exacerbated by political strife. Following this, on May 14, 2025, President Arce declared he would not pursue a second term, and subsequently, the government minister Eduardo del Castillo was put forward by MAS as his successor.

Protesters from different organisations are demonstrating against fuel shortages, economic conditions, and demands related to elections, causing disruptions to the usual movement of goods and vehicles. Recently, in June 2025, at least four people have been killed in anti-government demonstrations in Bolivia, related to upcoming elections in the country. Subsequently, Bolivian Justice Minister Cesar Siles has accused former president Evo Morales of “terrorism” for purportedly instructing his supporters to halt supplies to La Paz, the seat of government, in June 2025, and has filed a complaint against Morales. Despite the escalating economic crisis and rising social unrest, macroeconomic policies have largely stayed the same, with only a few measures taken to address urgent bottlenecks. Bolivia is set to conduct general elections on 17 August 2025, potentially followed by a second round on 19 October 2025. As the presidential elections approach, the government is likely to focus on initiatives that yield immediate benefits, even at the cost of long-term sustainability.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataConsidering the current economic and political headwinds, GlobalData expects the Bolivian construction industry to shrink by 3.8% in real terms in 2025 and then by a further 0.9% in 2026, before rebounding at an annual average rate of 4.1% from 2027 to 2029.