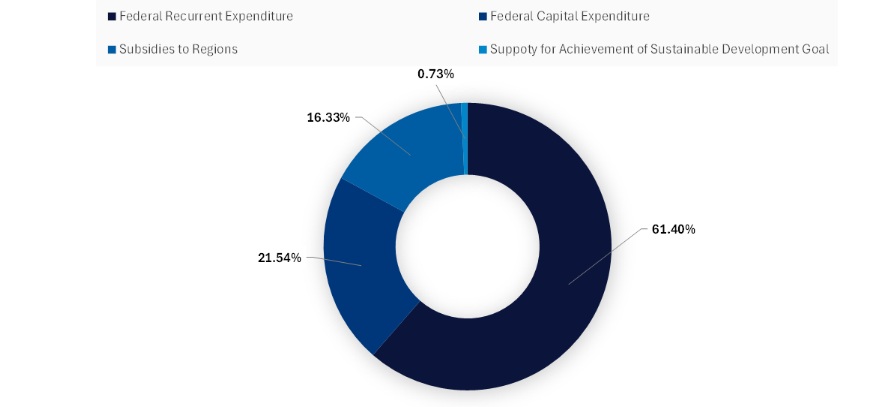

Ethiopia’s House of People’s Representatives approved the budget for the upcoming 2018 Ethiopian fiscal year (EFY, from 8 July 2025 to 7 July 2026) on 3 July 2025. As part of the latest budget, the total government expenditure is estimated to increase by 98.5%, from 971.2bn birr ($7.3bn) in the financial year 2024-25 (FY24-25) budget to 1.93tn birr in FY25-26, with 1.2tn birr in recurrent expenditure and 415bn birr in capital expenditure, 315bn birr in subsidies to regional states, and 4bn birr for regional support to achieve its Sustainable Development Goals. However, this sharp surge in the 2018 EFY budget is mostly driven by exchange rate effects rather than real fiscal expansion. The significant rise in nominal budget figures largely reflects the impact of currency depreciation following the adoption of a floating exchange rate in late June 2024, which saw the birr (Ethiopian local currency) weaken sharply – from an average of 57 birr in June 2024 to around 137 birr per US dollar in June 2025.

The budget was formulated in line with Ethiopia’s broader macroeconomic reform plan and prioritises ongoing development efforts, debt sustainability, and social protection. The sharp rise in expenditure is also a reflection of the government’s response to multiple overlapping crises – including food insecurity affecting over 16 million people, the Tigray conflict, and natural disasters such as floods and droughts – which have placed enormous pressure on the state. Rising tensions along the Eritrean border and the risk of renewed conflict in Tigray have further compelled the government to boost defence and internal security allocations. Increased allocations have also been directed towards humanitarian relief, agriculture, and water infrastructure to address urgent needs.

For the 2018 EFY, the revenue collection is expected to be 1.5tn birr, with 72.7% of the total, equivalent to 1.1tn birr, expected to be collected from taxes, and the rest from development partners and other sources. To boost revenue next year, new tax measures aim to raise 1.2tn birr from domestic sources. The government has allocated 463tn birr – around 24% of the total budget – for financing its domestic and external debt. Debt payments also make up to 39% of current spending. The budget also projects a 2.2% unadjusted deficit (excluding grants and one-time factors such as asset sales or emergency expenditure) and a 16% adjusted deficit (including all spending needs), which will be financed through treasury bill sales.

The budget prioritises support for low-income groups through targeted investments in infrastructure, education, agriculture, health, and regional development. In the budget, the government allocated 125.2bn birr for urban development and the construction sector, 115.5bn birr for the education sector, 81bn birr for the defence sector, 64.5bn birr for the agricultural and rural development sector, 60.9bn birr for the health sector, 40.1bn birr for the water and energy sector, 14.9bn birr for the transport and communication sector, 10.9bn birr for the culture and sports sector, 7.8bn birr for the trade industry and tourism sector, and 1.6bn birr for the mining sector.

The latest budget is anticipated to boost the construction sector, with leading data and analytics company GlobalData projecting the Ethiopian construction industry to grow by 9% in real terms in 2025. The proposed FY25-26 budget, aligned with Ethiopia’s 2025-2030 Medium-Term Macroeconomic and Fiscal Framework, reflects this focus by allocating substantial resources to capital expenditure and regional subsidies aimed at improving infrastructure and service delivery. The budget also benefits from recent macroeconomic reforms – including a market-based exchange rate system, adoption of a price-based monetary policy, and financial sector modernisation – that have enhanced fiscal transparency and investor confidence. These reforms are helping to stabilise inflation, improve foreign exchange availability, and support funding for large-scale construction programmes. Furthermore, the construction industry is expected to maintain an average annual growth rate of 7.8% from 2026 to 2029, supported by investments in transport infrastructure and renewable energy projects, along with the government’s Ten-Year Development Plan (2021-2030). The development plan aims to increase electricity service coverage from 44% in 2019 to 100% by 2030, expand power generation capacity from 4.2GW to 17.2GW, extend distribution lines from 16,018km to 21,728km, and significantly raise annual per capita electricity consumption from 86kWh to 1,269kWh during this period. Forecast-period growth in the Ethiopian construction industry will also be supported by the government’s plan to expand the national road network to 245,000km by 2032. In February 2025, the construction works commenced on the Ababa corridor development project in Addis Ababa; the project involves the construction of 477km of roads, over 100km of bike lanes, and 58 electric vehicle charging stations. The project aims to modernise the city’s infrastructure and transportation networks.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData