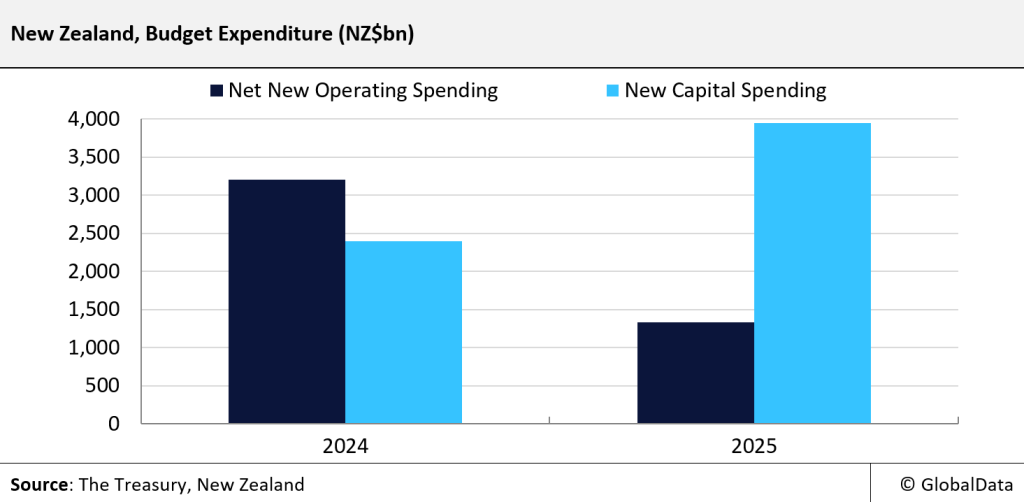

New Zealand’s Minister of Finance delivered the country’s 2025 Budget on May 22nd, 2025, with an average allocation of NZ$1.3bn ($777.1m) in net new spending. It includes NZ$6.7bn ($4bn) in new operating spending, supported by NZ$5.3bn ($3.2bn) in savings. The budget also includes a new capital investment of NZ$6.8bn ($4.1bn), within a net capital allowance of NZ$4bn ($2.4bn). The impact of the budget on the overall economy, particularly the construction sector, will be equivocal as the budget involves 228 new spending initiatives and 116 savings initiatives. The new spending initiatives are focused on boosting economic growth, in contrast to the savings initiatives, whose primary focus is to combat rising debt and government spending. Among the sectors, in terms of new operating spending, the healthcare sector received the largest allocation of NZ$1.8bn ($1.1bn), while the education sector received NZ$538m ($324.7m) and the transport sector received NZ$91m ($54.9m).

Overall, the budget focuses on key initiatives for boosting economic growth. The initiatives are expected to bolster the business confidence that will eventually foster business investments.

Major sector-wise allocation and initiatives:

Healthcare

- An increased funding of NZ$5.5bn ($3.3bn) for primary care, hospital and specialist services, and community and public health.

- Over NZ$1bn ($603.6m) for health infrastructure, which involves redevelopment of the Wellington Emergency Department and the Nelson Hospital, and the upgrade of the hospitals in Auckland.

- Over NZ$1bn ($603.6m) for additional cancer treatments.

- Over NZ$1bn ($603.6m) for hospitals and other healthcare facilities.

- The budget includes funding (held in contingency) for the redevelopment of Nelson Hospital under the initiative called the Nelson Hospital Redevelopment Program. The redevelopment works involve the construction of a new inpatient building and related facilities.

- The budget includes funding (held in contingency) for the upgradation of the Palmerston North Hospital under the initiative called the Nelson Hospital Redevelopment Program.

- Expansion of forensic mental health infrastructure within the Midland region with an operating funding of NZ$51m ($30.8m).

Education

- Over NZ$700m ($422.5m) for the construction of new schools, expansion of existing schools and new classrooms.

- A funding of NZ$646m ($389.9m) for the development of the education infrastructure for better learning for students.

Transport

- The budget includes funding of NZ$460m ($277.6m) for the upgradation of the rail network by 2027, for keeping the people and freight moving through the Rail Network Investment Programme (RNIP).

- The budget also includes an additional capital funding of over NZ$150m ($90.5m) for metropolitan rail renewals in Wellington and Auckland by 2027. This also includes the upgradation of airports at Whakatāne, Taupō, Westport, Whangārei and Whanganui.

Other key initiatives

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData- A total funding of NZ$182.5m ($110.2m) for the construction of new social homes and affordable rental properties.

- Establishment of three new Public Research Organisations by 2027 on innovation, science and technology with a funding of NZ$20m ($12.1m).

- The budget includes an allocation of NZ$35m ($21.1m) for the development of the tourism-related infrastructure as part of the International Visitor Conservation and Tourism Visitor Levy Investment Plan that was launched in 2019.

- A saving initiative involving the return of capital and operating funding from the Conservation Drinking Water Infrastructure Program tagged contingency due to the lower-than-expected costs.

- A saving initiative prioritised a funding cut of NZ$12.1m ($7.3m) from the Positive Behaviour for Learning (PB4L) School-Wide programme, which is expected to be utilised for the development of the education infrastructure.

- The budget includes funding (held in contingency) for the upgradation of the existing Parliament buildings. It involves heating infrastructure upgrade, fire sprinkler pipework replacement and ground floor window hardening.

The budgetary allocation of NZ$1.3bn ($777.1m) in new spending is down from a previously forecasted value of NZ$2.4bn ($1.4bn) as mentioned in the Half Year Update, which was released in December 2024. Before the release of the budget, in late-April 2025, finance minister Nicola Willis cautioned on this decline in the budgetary allocation, citing poor economic conditions coupled with the government’s aim to return to surplus by 2029. This shift reflects lower revenue and rising unemployment, which have constrained public investment, including infrastructure spending that is critical to the construction sector.

New Zealand’s construction industry in 2025 is operating under tightened fiscal and economic conditions as the government reduces baseline spending in response to slower-than-expected economic growth. The government is attempting to boost growth but faces challenges, and labour shortage problems caused by citizens leaving and settling in countries such as Australia in search of financial stability. One of the major reasons is that the average pay rate in Australia is 26% higher compared to New Zealand. According to Statistics New Zealand, New Zealanders leaving the country reached 243,324 in the first two months of 2025, representing a 16.3% year-on-year (YoY) growth from the same period of 2024. Earlier, in 2024, it grew by 15.3% in annual terms. Inflation in New Zealand peaked at 7.2% in 2022 and remained elevated at 5.7% in 2023. However, it declined to around 3% in 2024 and is projected to stabilise at approximately 2% by 2026, within the target range of 1%-3% of the central bank, the Reserve Bank of New Zealand (RBNZ). In response, the RBNZ has begun easing monetary policy, cutting rates from a high of 5.5% in July 2024 to 3.5% in April 2025, with the committee increasingly confident about further easing monetary policy restraints. Lower inflation and interest rates will likely reduce financing costs for construction projects, making mortgages and loans more affordable. This could support renewed demand in residential and commercial property markets, though lingering economic uncertainties may temper rapid expansion. However, amidst a broader national economic downturn – the worst since 1991 – the sector faces the compounded effects of high borrowing costs, weakened consumer confidence, and global trade disruptions.

Earlier, the RBNZ’s aggressive monetary tightening between 2021 and 2023 significantly slowed economic growth, reducing investment appetite in construction and delaying numerous housing and infrastructure projects. Although inflation has begun to ease and interest rates are declining in recent months, household debt remains high, with debt servicing costs at their highest in over a decade. Despite solid public finances, New Zealand faces challenges related to high household debt, which stands at approximately 169% of household nominal disposable income as of December 2024, primarily driven by mortgages. Debt servicing costs reached 11% of disposable income in 2024, the highest level since 2011. Although rate cuts will ease pressure, elevated debt levels may continue to constrain consumer spending and housing demand. For the construction sector, high household debt could limit new home purchases and mortgage approvals, affecting residential development. In December 2024, the government released its half-year review report, which showed that total debt is expected to reach NZ$192.8bn ($116.4bn) in 2025 and further rise to NZ$202.9bn ($122.5bn) in 2026. This is expected to limit expenditure on transport infrastructure and other social infrastructure projects.

The continued weakness further stems from low investor and housing developer confidence, driven by the cancellation or halt of housing projects amid tighter regulations. In February 2025, the government-owned housing arm Kāinga Ora revealed that its debt is expected to reach NZ$22.3bn ($13.5bn) in Financial Year (FY) 2027-28, up from NZ$18.7bn ($11.3bn) in FY2024/25, which will further limit investment in the housing sector. Previously, in September 2024, the government ordered a full review of Kāinga Ora’s operations, which suggested that its operational deficit is forecasted to balloon from NZ$520m ($313.9m) in FY2022/23 to NZ$700m ($422.5m) in FY2026/27. This review has resulted in a holdup in the construction of more than 300 social housing projects, as the viability of these projects was in doubt. This can result in a more restrained economic environment for construction-related projects, and government-backed development initiatives are expected to weigh on the construction industry. As a result, developers may need to adjust pricing strategies or focus on more affordable housing options to attract buyers in a financially constrained market. While opportunities remain, the construction sector must remain agile and risk-aware in an environment marked by macroeconomic fragility and political flux.

To combat rising debt, the country’s Budget 2025 focused on savings initiatives, some of which are:

- The budget includes a cut of NZ$400.5m ($241.7m) of operating funding and a NZ$382.8m ($231m) of capital funding across the Housing Portfolio. This involves scrapping of Contracted Emergency Housing amid workload pressures, for which jobseeker reforms require priority. This includes a funding cut of NZ$125m ($75.4m) in total capital funding from NZ$1.1bn ($663.9m) to NZ$ 925.6m ($558.7m) for the construction of Kāinga Ora’s Large-Scale Projects amid failure to meet the Government’s tightened criteria. Also in late April 2025, the Ministry of Social Development (MSD) reported that the emergency housing market is weakening due to tightened eligibility criteria.

- A savings initiative was undertaken to pause the funding of the Greater Christchurch Education Renewal Program, which involved the reconstruction of Christchurch schools destroyed by the Canterbury earthquakes on February 22nd, 2011.

- The budget includes the removal of the New Classroom Set-Up grant and a pause in funding for the development of Study Support Centres (SSCs).

Additionally, under New Zealand’s voluntary savings scheme KiwiSaver, the annual contribution from the government to the KiwiSaver accounts is cut down from NZ$521 ($314.5) to NZ$260.72 ($157.4) per year. Also, for those income earners earning more than NZ$180,000 ($108,644) per annum, there will be no Government contribution. These changes in the scheme are projected to save NZ$2.5bn ($1.5bn) over four years for the government. Undertaking savings initiatives and cutting down contributions under the KiwiSaver scheme can subsequently reduce the government debt, but these savings initiatives will reduce the construction output in 2025. Furthermore, tighter government project permit regulations have resulted in halting several construction projects due to incurring losses and rising construction costs.

In order to partially assist businesses from facing skyrocketing losses, the budget focused on boosting consumer spending and providing tax incentives to businesses. The initiative involving the expansion of the Rate Rebate Scheme will support consumer spending. Under the scheme, the income threshold is raised from NZ$31,510 ($19,018.7) to NZ$45,000 ($27,161) per annum, and the maximum rebate is increased from NZ$790 ($476.8) to NZ$805 ($485.9). This will enable 66,000 new lower-income households to have a SuperGold cardholder to get a rates rebate. Furthermore, in contrast to the changes involving cutting down the government’s contributions under the KiwiSaver scheme, the budget includes additional changes which is expected to partially support consumer spending. One of the changes includes eligibility of the 16- and 17-year-olds for the government contributions to their respective KiwiSaver accounts from April 2026, which is currently available to those who are 18 and above. Additionally, the default rate of employer and employee contributions for KiwiSaver will rise from 3% of salary and wages to 4% in two steps. From April 1st, 2026, the rate will become 3.5%, and from April 1st,2028, it will become 4%.

For a further boost to consumer spending, the budget included a Tax Deferral Regime, which will allow employees to not pay taxes immediately on the shares received as part of their compensation. Instead, the employees are allowed to defer the tax payments to a later date, which can help them with financial planning.

The budget also includes a tax incentive for businesses to boost investments in productive assets such as equipment, machinery and tools through a partial expensing regime called ‘Investment Boost’. This will provide the businesses with an instant tax deduction of 20% of the purchase price of the new assets. This is expected to lift the business investment levels in the coming years. Although these can support the investments in construction projects, GlobalData expects the construction industry in New Zealand to contract by 1% in real terms in 2025, owing to mounting debt, a fall in building permits, labour shortages, and rising construction material costs – especially for cement.